CHOICE SAVINGS ACCOUNT

START THEM OFF ON THE RIGHT FOOT WITH SMART FINANCIAL HABITS AND SAVINGS TIPS

KIDS SAVINGS ACCOUNT FEATURES:

Earns Interest

Teach them the value of their money earning money.

Low Minimums

No minimum balance requirements or monthly maintenance fees.

Convenient Access

Access your account 24/7 with free online banking and mobile banking or visit one of our local banking centers.

LET YOUR MONEY WORK FOR YOU

ENJOY THE BEST SAVINGS ACCOUNT INTEREST RATES

Teach them first-hand the value of putting your money to work in interest-bearing accounts. Help them reach their long-term savings goals and learn smart money management that will follow them into young adulthood and beyond!

Rate Effective Date: April 28, 2025

| Specifications | Amount |

|---|---|

| Minimum Opening Deposit: | $10 |

| Minimum Balance to Earn APY: | $10 |

| Interest Rate: | 0.10% |

| Annual Percentage Yield (APY): | 0.10% |

The rate may change after the account is opened. Fees could reduce earnings on the account

ENJOY EXCLUSIVE PERKS WITH EVERY COUNTRY BANK SAVINGS ACCOUNT

ATM Card

Link to a Mastercard® Debit Card

Online Banking

Mobile Banking with Free Mobile Deposit

Text Banking

eStatements

DISCOVER THE BEST SAVINGS ACCOUNT FOR YOUR NEEDS

| feature | kasasa saver | statement savings account | 18/65 savings account | choice savings account | |

| Minimum Opening Balance | $10 | $10 | $10 | $10 | |

| Minimum Balance to Earn APY | $0 | $10 | $10 | $10 | |

| Monthly Fee | $0 | $0 | $0 | $0 | |

| Earns Interest | YES | YES | YES | YES | |

| Reduced NSF Fees | NO | NO | YES | NO |

18/65 SAVINGS ACCOUNT

As mandated by Massachusetts Law, customers 18 years of age and under or 65 years of age and older, are entitled to an account that is free of monthly service charges.

CERTIFICATE OF DEPOSIT (CD)

Looking to earn a higher rate for college education or other expenses as your child turns 18? Consider a CD which typically pays a higher rate of interest for a fixed period of time you choose. Varying terms are available with a $500 minimum to open.

INVEST IN A BRIGHTER FUTURE

UNLOCK YOUR POTENTIAL WITH MONEY SCHOOL

Prepare for a lifetime of financial wellness with free resources empowering you to make smart money choices. Money School is an engaging program that puts you on the path to financial success!

BANKING MADE SIMPLE

SAVINGS ACCOUNT RESOURCES

Take control of your finances with free savings account tools and resources.

Savings Accounts

Money Market Accounts

VIEW ALL RESOURCES

SAVINGS ACCOUNT FAQs

What forms of identification do I need to open an account?

Individuals will need one primary form of identification. Alternatively, if one of the primary forms of ID cannot be provided, two secondary forms of identification are required Minors need to provide a birth certificate as one of their secondary forms of identification.

Primary

Driver’s License or ID Card

Passport

Permanent Resident Card (Green Card)

Firearms Permit

Police, Civil Service, Military Identification

U.S Visa

Secondary

Social Security Card

Credit Card with picture and signature

Employee ID with picture and signature

Health Care/Insurance Card (containing a name and member number)

Current Utility Bill (showing current address)

Student ID with picture and signature

Current Credit Card Bill (showing current address)

Birth Certificate (Required for minors) or Marriage Certificate

EBT Card (Massachusetts Residents only)

Pay Stub (current)

Vehicle Registration

ITIN Card (non-U.S Person)

Can I deposit money into my savings account at any Country Bank ATM/ITM?

Yes, at most of our ATM/ITM locations. The only location that cannot accept deposits is the Worcester Public Market.

How are my deposits insured?

All deposits are insured through the combined coverage of the FDIC (Federal Deposit Insurance Corporation) and the DIF (Depositor’s Insurance Fund). Under the FDIC, the standard insurance amount is $250,000 per depositor, for each ownership category. As a depositor in this bank, all of your deposits and accrued interest are insured in full without limit or exception. All deposits above the FDIC limit are insured in full by the Depositors Insurance Fund.

There has been a lot in the news lately about deposit insurance and bank safety. This question and answer section is to provide you with useful information about the safety and security of your funds at Country Bank. You can be confident that Country Bank is in a strong financial position and your interests are safe. In fact, the deposits of Country Bank customers are backed by the Federal Deposit Insurance Corporation (FDIC) to the maximum extent allowed by law. Additionally, the Depositors Insurance Fund insures all deposit amounts above FDIC limits in full.

LEARN MORE: FDIC

LEARN MORE: DIF

The combination of FDIC and DIF insurance provides Country Bank customers with full deposit insurance on all their deposit accounts. If you need more information or would like to discuss your accounts, please visit any of our branches or contact our Customer Care Center at 800-322-8233.

What other information do I need to know about minor accounts?

ATM Card: A minor may have an ATM card on their statement savings account as long as the parent/legal guardian signs as the responsible party.

Debit Card: A minor may have a debit card on their student checking account as long as the parent/legal guardian signs as the responsible party.

Notations:

On accounts owned individually or jointly by a minor, deposits and withdrawals are allowed without requiring permission from the parent/legal guardian. If the parent/legal guardian wishes to eliminate the minor’s ability to withdraw, they may want to consider opening an account with the minor as beneficiary, which means they will not have the capability to withdraw.

-

- If a minor owns an account jointly, only the account owners can withdraw from the account. The parent/legal guardian has no right to the funds unless they are a joint account holder. The parent/legal guardian may come in with the minor, and then we would allow the minor to withdraw.

- If a minor owns an account individually and the parent/legal guardian comes in wishing to withdraw from the minor’s account, they must prove that they are the parent or legal guardian.

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

SKIP THE TRIP

MOBILE BANKING

24/7 Access

Manage your accounts from the palm of your hand whenever it’s convenient for you.

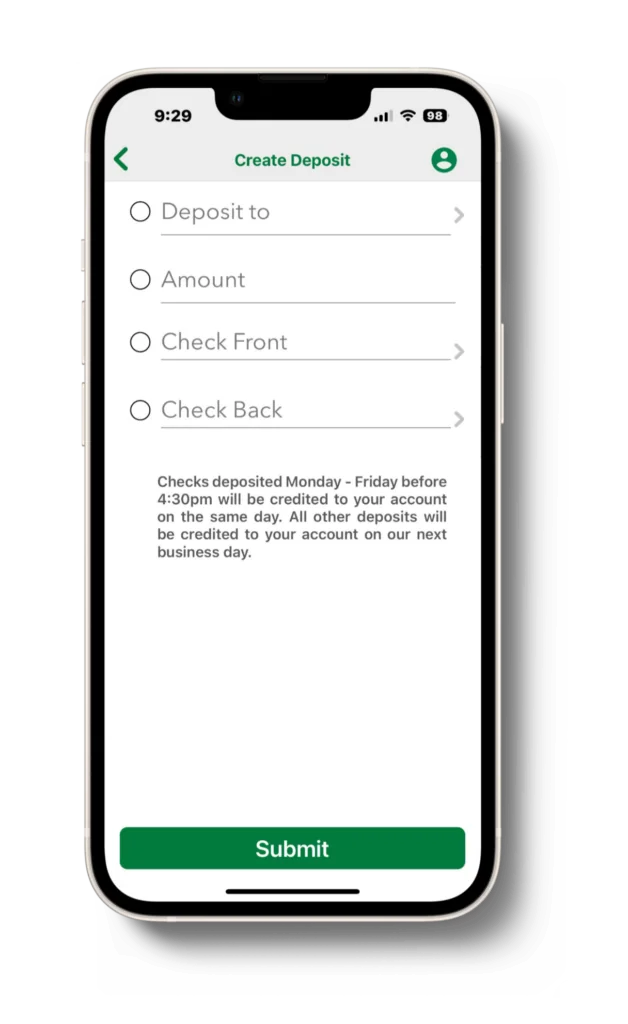

Mobile Deposit

Deposit checks with the snap of a photo.

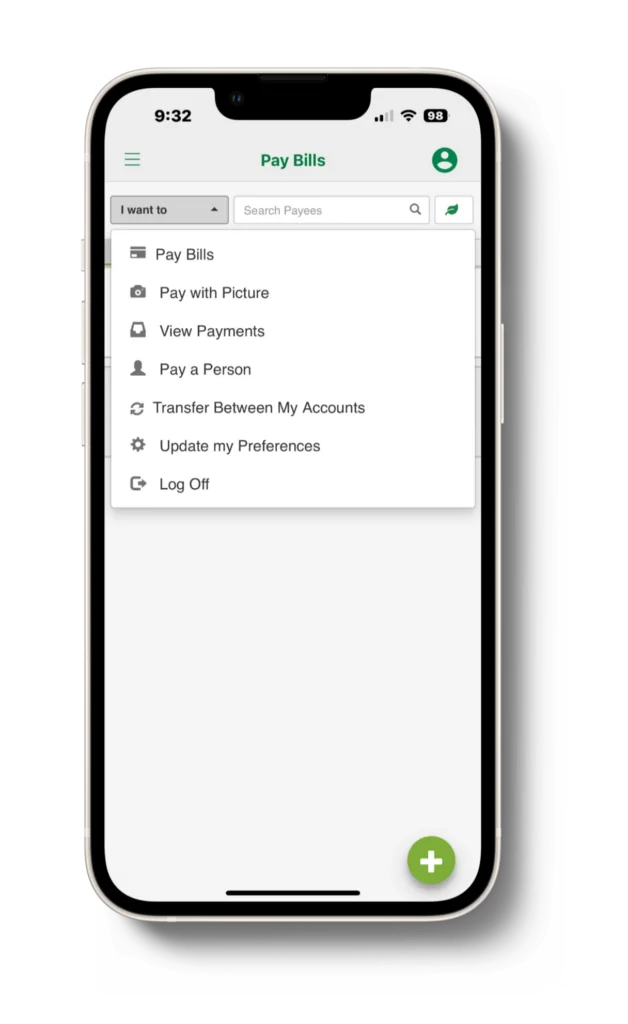

Transfer Money

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.