Teaching Children About Money

Whether you’re teaching finances to your kids, your grandkids, or those of a loved one, it’s absolutely essential to teach […]

Read More

Teach them the value of their money earning money.

No minimum balance requirements or monthly maintenance fees.

Access your account 24/7 with free online banking and mobile banking or visit one of our local banking centers.

Teach them first-hand the value of putting your money to work in interest-bearing accounts. Help them reach their long-term savings goals and learn smart money management that will follow them into young adulthood and beyond!

| Specifications | Amount |

|---|---|

| Minimum Opening Deposit: | $10 |

| Interest Rate: | 0.10% |

| Annual Percentage Yield (APY): | 0.10% |

ATM Card

Link to a Mastercard® Debit Card

Online Banking

Mobile Banking with Free Mobile Deposit

Text Banking

eStatements

| feature | kasasa saver | statement savings account | 18/65 savings account | choice savings account | |

| Minimum Opening Balance | $10 | $10 | $10 | $10 | |

| Minimum Balance to Earn Interest | $10 | $10 | $10 | $10 | |

| Monthly Fee | $0 | $0 | $0 | $0 | |

| Earns Interest | YES | YES | YES | YES | |

| Reduced NSF Fees | NO | NO | YES | NO |

Through our partnership with Greenlight, your child can have a debit card of their own, while you set flexible controls and get real-time notifications of their money activity. This app is a great way to introduce children to finances and teach them how to manage their money.

As mandated by Massachusetts Law, customers 18 years of age and under or 65 years of age and older, are entitled to an account that is free of monthly service charges.

Looking to earn a higher rate for college education or other expenses as your child turns 18? Consider a CD which typically pays a higher rate of interest for a fixed period of time you choose. Varying terms are available with a $500 minimum to open.

Prepare for a lifetime of financial wellness with free resources empowering you to make smart money choices. Money School is an engaging program that puts you on the path to financial success!

Take control of your finances with free savings account tools and resources.

Whether you’re teaching finances to your kids, your grandkids, or those of a loved one, it’s absolutely essential to teach […]

Read More

Getting Interested With a savings account, you earn interest, or a percentage of your balance, on the money in your […]

Read More

There are many options for keeping your money safe and earning a little extra from interest. Like a savings account […]

Read MoreIndividuals will need one primary form of identification. Alternatively, if one of the primary forms of ID cannot be provided, two secondary forms of identification are required Minors need to provide a birth certificate as one of their secondary forms of identification.

Primary

Driver’s License or ID Card

Passport

Permanent Resident Card (Green Card)

Firearms Permit

Police, Civil Service, Military Identification

U.S Visa

Secondary

Social Security

Credit Card with picture and signature

Employee ID with picture and signature

Health Care/Insurance Card (containing a name and member number)

Current Utility Bill (showing current address)

Student ID with picture and signature

ChexDystem Report (showing previous and current address)

Current Credit Card Bill (showing current address)

Birth Certificate (Required for minors) or Marriage Certificate

EBT Card (Massachusetts Residents only)

Pay Stub (current)

Vehicle Registration

ITIN Card (non-U.S Person)

Yes, at most of our ATM/ITM locations. The only location that cannot accept deposits is the Worcester Public Market.

All deposits are insured through the combined coverage of the FDIC (Federal Deposit Insurance Corporation) and the DIF (Depositor’s Insurance Fund). Under the FDIC, the standard insurance amount is $250,000 per depositor, for each ownership category. As a depositor in this bank, all of your deposits and accrued interest are insured in full without limit or exception. All deposits above the FDIC limit are insured in full by the Depositors Insurance Fund.

There has been a lot in the news lately about deposit insurance and bank safety. This question and answer section is to provide you with useful information about the safety and security of your funds at Country Bank. You can be confident that Country Bank is in a strong financial position and your interests are safe. In fact, the deposits of Country Bank customers are backed by the Federal Deposit Insurance Corporation (FDIC) to the maximum extent allowed by law. Additionally, the Depositors Insurance Fund insures all deposit amounts above FDIC limits in full.

LEARN MORE: FDIC

LEARN MORE: DIF

The combination of FDIC and DIF insurance provides Country Bank customers with full deposit insurance on all their deposit accounts. If you need more information or would like to discuss your accounts, please visit any of our branches or contact our Customer Care Center at 800-322-8233.

ATM Card: A minor may have an ATM card on their statement savings account as long as the parent/legal guardian signs as the responsible party.

Debit Card: A minor may have a debit card on their student checking account as long as the parent/legal guardian signs as the responsible party.

Notations:

Uniform Transfer to Minors Act (UTMA) The Uniform Transfer to Minors Act is a state law that allows an adult (custodian) to make an irrevocable gift to a minor. The custodian is obligated by law to use the money for the sole benefit of the minor, and when the minor reaches age 21, the custodian must turn the money over to the minor. Only the custodian can transact business on the account There can only be one custodian and one minor assigned to an account. If the minor dies before the age of 21, the money belongs to the minor’s estate.

In the event that the custodian dies, a successor custodian must be appointed by the Court. The Successor Custodian is not automatically the parent/legal guardian of the minor.

Totten Trust, also known as an “Informal Trust” or “Unwritten Trust.” These trusts may be set up with one or two trustees, for the benefit of multiple beneficiaries. The trustees have legal title to the money and if more than one, either trustee or the survivor trustee may withdraw funds and transact business on the account. Until death of the trustee(s), the beneficiary(ies) has no right to withdraw funds from the account. Upon the death of all the trustees, the beneficiary(ies) may then close out the account

Experience the difference of exceptional service when you stop by a local banking center.

FIND LOCATIONS

Manage your accounts from the palm of your hand whenever it’s convenient for you.

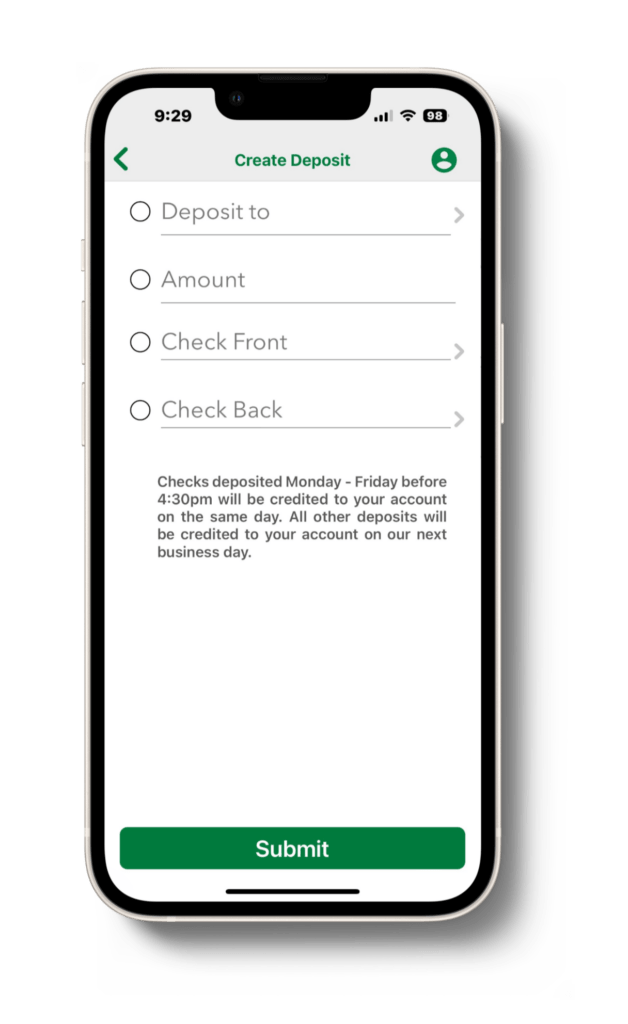

Deposit checks with the snap of a photo.

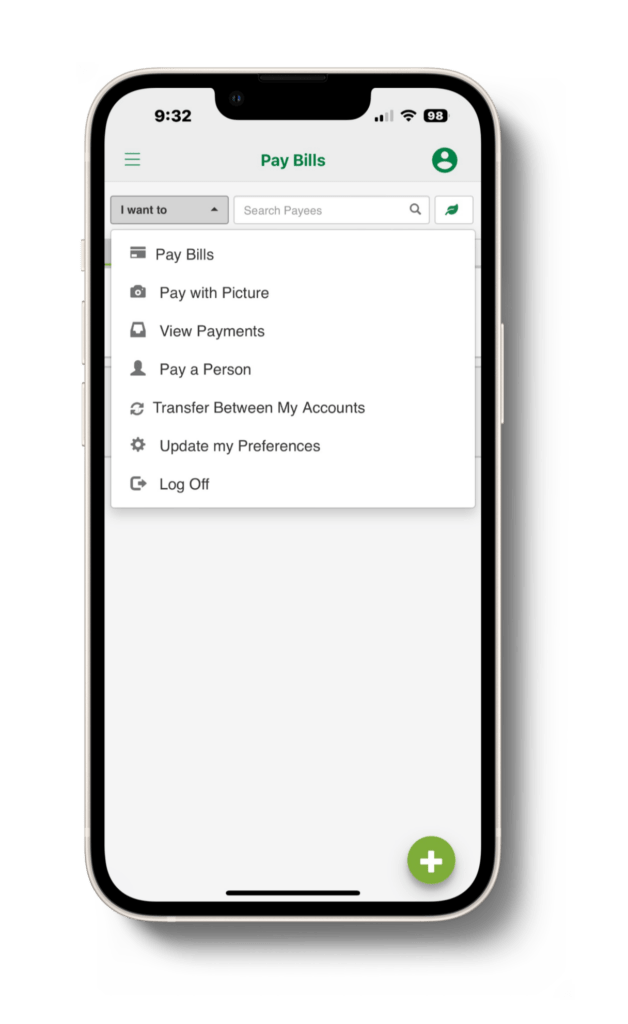

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.