Teaching Children About Money

Whether you’re teaching finances to your kids, your grandkids, or those of a loved one, it’s absolutely essential to teach […]

Read More

As a student, balancing school, work, and everything else, you’ve got a busy schedule. It’s why we created this free and simple student checking account that goes wherever you go. Plus, receive $251 when you open an account.

You have plenty of things to worry about every day. Fees shouldn’t be one of them.

Open your student checking account online with a $10 deposit and never worry about a minimum balance.

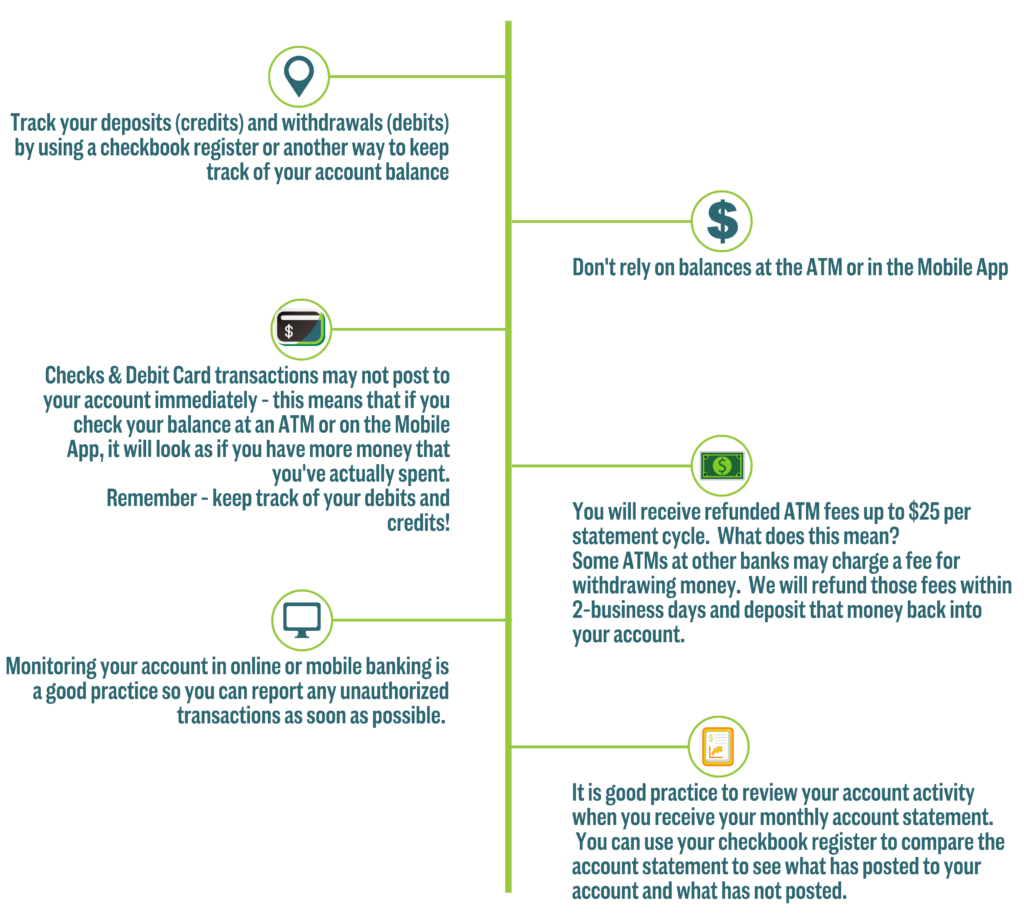

Receive up to $25 in ATM fee refunds per qualification cycle.1

Mastercard® Debit Card With eGuard Secure Solution

Online Banking with Free Bill Pay

Mobile Banking with Free Mobile Deposit

Text Banking

eStatements

| Feature | Free Checking Account | Kasasa Cash back account1 | Kasasa cash account1 | 18/65 Checking Account | Student Checking Account2 |

| Minimum Opening Balance | $10 | $10 | $10 | $10 | $10 |

| Minimum Balance to Earn Interest | N/A | N/A | $0 | N/A | N/A |

| Monthly Fee | $0 | $0 | $0 | $0 | $0 |

| Earns Interest | No | No | Yes | No | No |

| Reduced NSF Fees | No | No | No | Yes | No |

If you’re 22 or under, you must be listed as the primary account owner.

If you’re 18 or older, open your student checking account online. You’ll need one primary and one secondary form of identification to open your account.

Ages 17 or younger must visit a banking center to open an account and have a parent or guardian on the account. Minors will need two secondary forms of identification.

Start your financial journey on the right foot! With your student checking account, you’ll get a debit card of your very own to start learning and practicing smart spending habits. With a student bank account at Country Bank, you can make point-of-sale purchases, access your money at ATMs, transfer money to friends and family, and monitor your account with free online and mobile banking.

When you open your first checking account, you take the first step toward independence. It’s a big responsibility, but managing your money successfully is within your reach. Remember, the key to success is never spending more money than you have available in your account.

Prepare for a lifetime of financial wellness with free resources empowering you to make smart money choices. Money School is an engaging program that puts you on the path to financial success!

Take control of your finances with free checking account tools and resources.

Whether you’re teaching finances to your kids, your grandkids, or those of a loved one, it’s absolutely essential to teach […]

Read More

Getting Interested With a savings account, you earn interest, or a percentage of your balance, on the money in your […]

Read More

There are many options for keeping your money safe and earning a little extra from interest. Like a savings account […]

Read MoreDISCLOSURES:

1 Qualifications, limits and other requirements apply to earn ATM refunds and high interest or cash back rewards. See financial institution for details. If qualifications are met, reimbursements up to $9.99 per transaction, with an aggregate total of $25 for nationwide ATM withdrawal

fees incurred on your Kasasa account during the Monthly Qualification Cycle in which you qualified. Please note that ATM fee reimbursements only apply to Kasasa Cash, and Kasasa Cash Back accounts. Kasasa Saver ATM transaction fees are not reimbursed nor refunded. ATM fee reimbursements may be tax reportable, please consult your tax advisor. Limited to one account per SSN/TIN.

Account Qualifications (per qualification cycle): Have at least 12 debit card purchases post and settle; have at least one direct deposit, one automatic ACH transaction post and settle; and be enrolled in and agree to receive eStatements.

The interest rate and annual percentage yield may change after account opening.Fees could reduce the earnings on the account.

Kasasa, Kasasa Cash Back, Kasasa Cash and Kasasa Saver are trademarks of Kasasa, Ltd., registered in the U.S.A.

2 You must deposit $10.00 to open this account. The primary account owner must be 22 years of age or younger. Minors (under the age of 18) will require a parent or guardian to be a joint owner on the account. We will refund an aggregate of $25.00 for nationwide ATM withdrawal fees imposed by other financial institutions and incurred during the monthly statement cycle. Generally, the refund will be credited to your account within 2 business days. When the primary account holder reaches the age of 23, the Student Checking account will automatically convert into a checking account, disclosures will be provided at that time. Please note that rates, fees, and balance requirements may vary based on the account available at that time. Must be 18 or older to open online. Limited to one account per SSN/TIN.

Individuals will need one primary form of identification. Alternatively, if one of the primary forms of ID cannot be provided, two secondary forms of identification are required Minors need to provide a birth certificate as one of their secondary forms of identification.

Primary

Driver’s License or ID Card

Passport

Permanent Resident Card (Green Card)

Firearms Permit

Police, Civil Service, Military Identification

U.S Visa

Secondary

Social Security Card

Credit Card with picture and signature

Employee ID with picture and signature

Health Care/Insurance Card (containing a name and member number)

Current Utility Bill (showing current address)

Student ID with picture and signature

Current Credit Card Bill (showing current address)

Birth Certificate (Required for minors) or Marriage Certificate

EBT Card (Massachusetts Residents only)

Pay Stub (current)

Vehicle Registration

ITIN Card (non-U.S Person)

ATM Card: A minor may have an ATM card on their statement savings account as long as the parent/legal guardian signs as the responsible party.

Debit Card: A minor may have a debit card on their student checking account as long as the parent/legal guardian signs as the responsible party.

Notations:

On accounts owned individually or jointly by a minor, deposits and withdrawals are allowed without requiring permission from the parent/legal guardian. If the parent/legal guardian wishes to eliminate the minor’s ability to withdraw, they may want to consider opening an account with the minor as beneficiary, which means they will not have the capability to withdraw.

DISCLOSURES

1You must deposit $10.00 to open this account. The primary account owner must be 22 years of age or younger. Minors (under the age of 18) will require a parent or guardian to be a joint owner on the account. We will refund an aggregate of $25.00 for nationwide ATM withdrawal fees imposed by other fi nancial institutions and incurred during the monthly statement cycle. Generally, the refund will be credited to your account within 2 business days. When the primary account holder reaches the age of 23, the Student Checking account will automatically convert into a checking account, disclosures will be provided at that time. Please note that rates, fees, and balance requirements may vary based on the account available at that time. Must be 18 or older to open online. Limited to one account per SSN/TIN.

Experience the difference of exceptional service when you stop by a local banking center.

FIND LOCATIONS

Manage your accounts from the palm of your hand whenever it’s convenient for you.

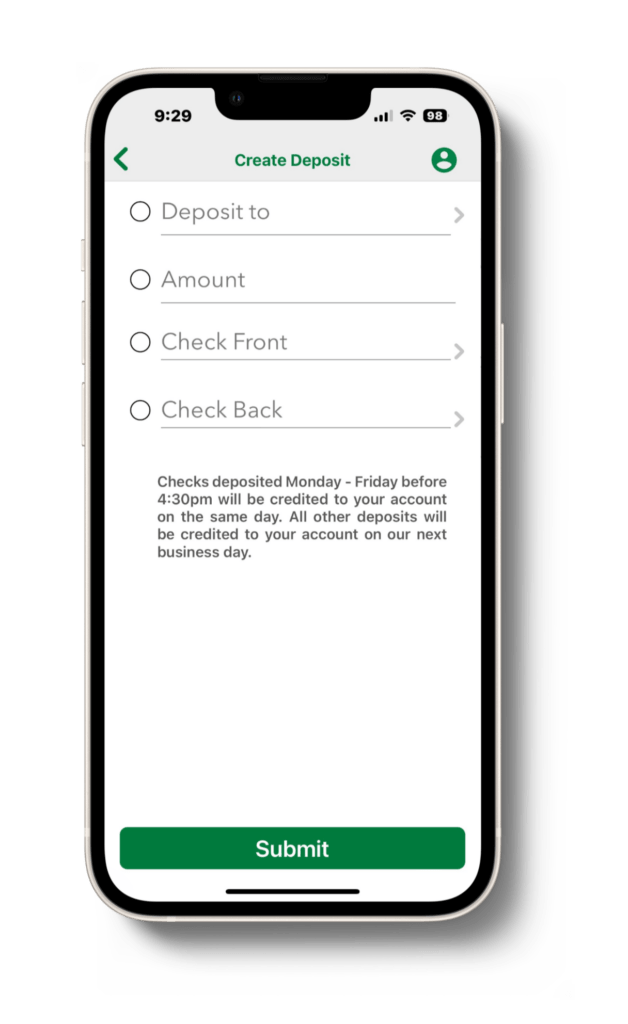

Deposit checks with the snap of a photo.

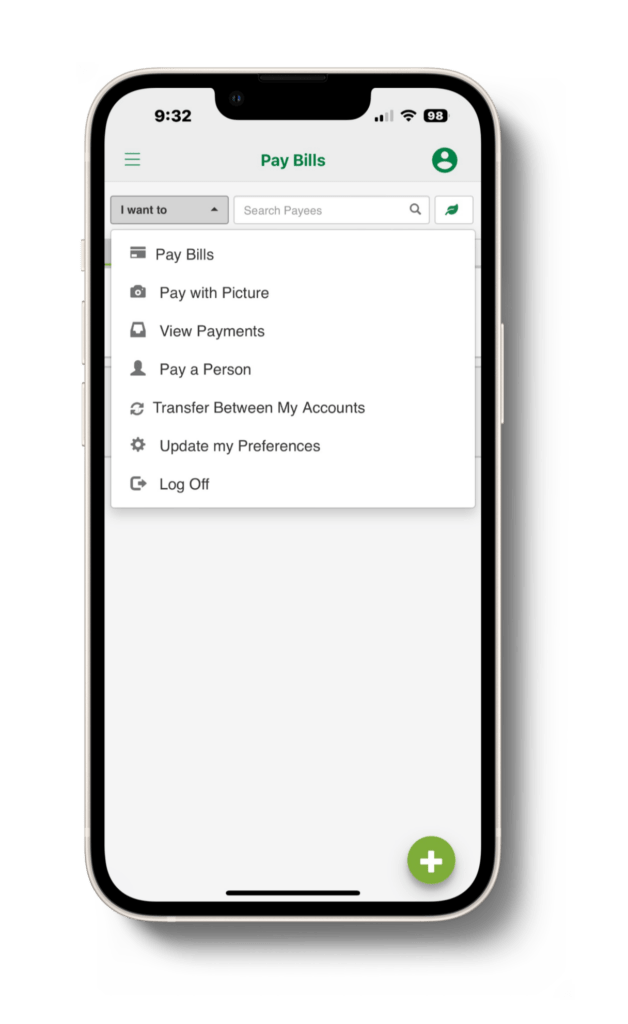

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.