Justin Calheno

VICE PRESIDENT, RETAIL LENDING BUSINESS DEVELOPMENT OFFICER

NMLS #5549

jcalheno@countrybank.com

Direct Dial: 413-277-2370

Cell: 413-626-0395

Fax: 413-234-3243

Say goodbye to the city and hello to rural homeownership with competitive USDA mortgage rates.

| Product | Interest Rate | Points | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| 30 Year | 6.875% | 0 | 7.458% | $6.64 |

Disclosure:

Income restrictions apply.

Rates, and APR (Annual Percentage Rate) are subject to change based on factors such as points, loan amount, loan-to-value, borrowers’ credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All Loans Subject to Credit Approval.

Country Bank will lock in the interest rate for seventy-five (75) calendar days upon receipt of signed Intent to Proceed and applicable application fee.

Annual Percentage Rate (APR) based on guarantee fee of 1.00% and annual fee of 0.35%

Owning a home in the countryside has never been easier! USDA loans don’t require any down payment.

USDA loans do not have a strict credit score requirement, which makes it a great option for those with a less-than-perfect credit score. At Country Bank, our minimum required credit score is 620.

If you are looking to purchase or refinance a home in one of the many quaint/rural towns across Massachusetts, a USDA loan could be the best financing option to help you achieve your goals.

A USDA home loan is a type of mortgage that is guaranteed by the United States Department of Agriculture (USDA). This guarantee results in many benefits home buyers can take advantage of such as competitive interest rates, flexible credit requirements, and no down payment obligation which all end up with more savings in your bank account.

Taking a closer look at the details of each program helps you find the best solution for your homeownership goals. Here are the USDA eligibility requirements to help you decide if a USDA home loan is your entryway to homeownership:

Your property must be located in an eligible rural area.

When you’re applying for a mortgage, it’s important to have someone you trust at your side. We’re experts at walking you through the entire process, answering your questions, and cheering you on to success. It’s what we’re made to do.

VICE PRESIDENT, RETAIL LENDING BUSINESS DEVELOPMENT OFFICER

NMLS #5549

jcalheno@countrybank.com

Direct Dial: 413-277-2370

Cell: 413-626-0395

Fax: 413-234-3243

RETAIL LOAN OFFICER

NMLS #432695

jsoucia@countrybank.com

Direct Dial: 413-277-2348

Cell: 413-262-2141

Fax: 866-757-5784

RETAIL LOAN OFFICER

NMLS #618959

jvelez@countrybank.com

Direct Dial: 413-277-2318

Cell: 413-636-2925

Fax: 866-506-7515

RETAIL LOAN OFFICER

NMLS #432698

kkemp@countrybank.com

Direct Dial: 413-277-2383

Cell: 774-200-5017

Fax: 866-726-4071

RETAIL LOAN OFFICER

NMLS #689658

lsanchez@countrybank.com

Direct Dial: 413-277-2041

Cell: 413-209-4823

Bilingual – English & Spanish

Servicio en Español

Take control of your future finances and set yourself up for success by making informed mortgage choices today.

We have you covered! Here is the information you’ll need when you are ready to apply for a mortgage.

STEP 1: GET PRE-QUALIFIED TO MAKE YOUR PURCHASE

Fill out a mortgage application for a prequalification. As part of this process we will obtain your credit report and request income documentation. We will then determine the amount you would be approved for and issue a prequalification letter. This letter can be used to put in an offer on a home.

STEP 2: APPLYING FOR YOUR MORTGAGE LOAN

If you are purchasing a property, you will want to contact your loan officer to get your mortgage application started and submitted once an offer is accepted. If you already own the property than simply reach out to a loan officer to get the mortgage application started and submitted.

STEP 3: REVIEW LOAN ESTIMATE

Once we have received and processed your submitted mortgage application, you will receive your initial loan disclosure paperwork which includes your loan estimate (a breakdown of potential closing costs associated with your transaction).

STEP 4: PROPERTY APPRAISAL

Once you have reviewed your initial disclosure package and signed your intent to proceed. The appraisal fee will be collected and your appraisal will be ordered. The property will be appraised to establish its current market value.

STEP 5: UNDERWRITING PROCESS

The Loan Processor will submit your paperwork to a Residential Mortgage Underwriter who will underwrite this file to secondary market guidelines.

STEP 6: LOAN APPROVAL PACKAGE

After underwriting has approved your mortgage, the loan approval package will be sent out to you. Typically, this package will contain any outstanding loan conditions that are needed before the closing can be scheduled with the attorney. Once underwriting has received and reviewed the outstanding conditions, the loan will be cleared to close. At that point you will begin to work on scheduling the closing with your attorney. At least three days before your closing, you will receive your initial closing disclosure. This is a very important document as it breaks down the amount needed to bring to the closing.

STEP 7: CLOSING

The “closing” is the last step in buying and financing a home. This is when you and all the other parties in a mortgage loan transaction sign the necessary documents. Before you sign, make sure you carefully read and understand all the loan documents.

Credit requirements are dependent on many different factors, including the loan program applied for. If you are unsure of how your credit history will affect your application, please contact one of our loan officers who will discuss options with you.

Closing costs are the fees you pay to complete your loan; they include but are not limited to origination fee, title insurance, prepaid escrows, and more. Closing costs will vary depending on many different factors including the loan program applied for, down payment, etc. Your loan officer will provide you with a loan estimate that will break down expected closing costs.

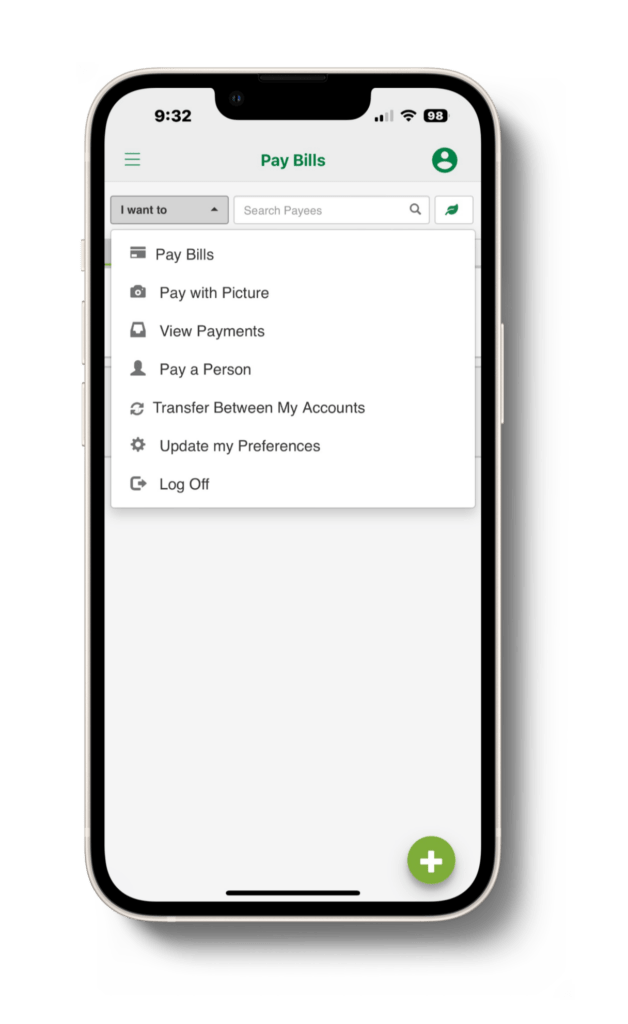

Experience the difference of exceptional service when you stop by a local banking center.

Knowing where your current mortgage stands can help you manage refinancing possibilities in the future.

In just a few taps, you can pay your mortgage or even set up a recurring payment so you can focus on what matters most.

Make an extra principal-only payment on your mortgage so you can pay your loan off faster.