Shane Elder

FIRST VICE PRESIDENT, BUSINESS BANKING TEAM LEAD COMMERCIAL LOAN OFFICER

Direct Dial: 413-277-2112

Cell: 508-440-1616

Country Bank is providing loans for hundreds of small businesses planning to launch and grow. We can lift up your business too, with an SBA Loan tailored to your unique needs and rates that fit your budget and business plan.

SBA loans feature competitive rates that are often lower than traditional business loans

SBA loans can be used to purchase equipment, buy real estate, refinance existing debt, expand operations, and increase working capital.

With longer repayment periods, you’ll enjoy more time to pay back what you have borrowed.

Help newly formed Businesses

Buy Commercial Real Estate

Refinance Existing Business Debt

Increase Working Capital

Finance Machinery

Expand Your Current Business

A SBA loan is guaranteed by the federal government (Small Business Administration) making it one of the most affordable loans available to business owners. Applying for a SBA loan through a trusted lender like Country Bank offers your business the chance to unlock its true potential with the financial support you need to support and grow your business. Whether you are looking to expand, buy equipment, or increase your working capital, an SBA loan can help make your business dreams come true.

Contact one of our business lending experts to determine if your business qualifies.

A Business Banking lender will determine what documents are needed.

Apply for your business loan with Country Bank and understand you are getting more than a loan. You will receive a banking partnership with the capacity to support your growth and anticipate your business challenges ahead whether those remain in Massachusetts or expand to Southern New Hampshire, Southern Maine, Rhode Island, or Connecticut. We’ve got your back.

Your growing business needs a bank that can do more than just keep up. You need a team that stays one step ahead and understands what’s at stake. Our team of experts understands what Massachusetts businesses are up against, and we are dedicated to creating unique solutions that fit your business.

FIRST VICE PRESIDENT, BUSINESS BANKING TEAM LEAD COMMERCIAL LOAN OFFICER

Direct Dial: 413-277-2112

Cell: 508-440-1616

VICE PRESIDENT, BUSINESS BANKING LOAN OFFICER

calves@countrybank.com

Direct dial: 413-277-2110

Cell: 413-530-7608

VICE PRESIDENT, BUSINESS BANKING LOAN OFFICER

mwilliams@countrybank.com

Direct Dial: 413-277-2134

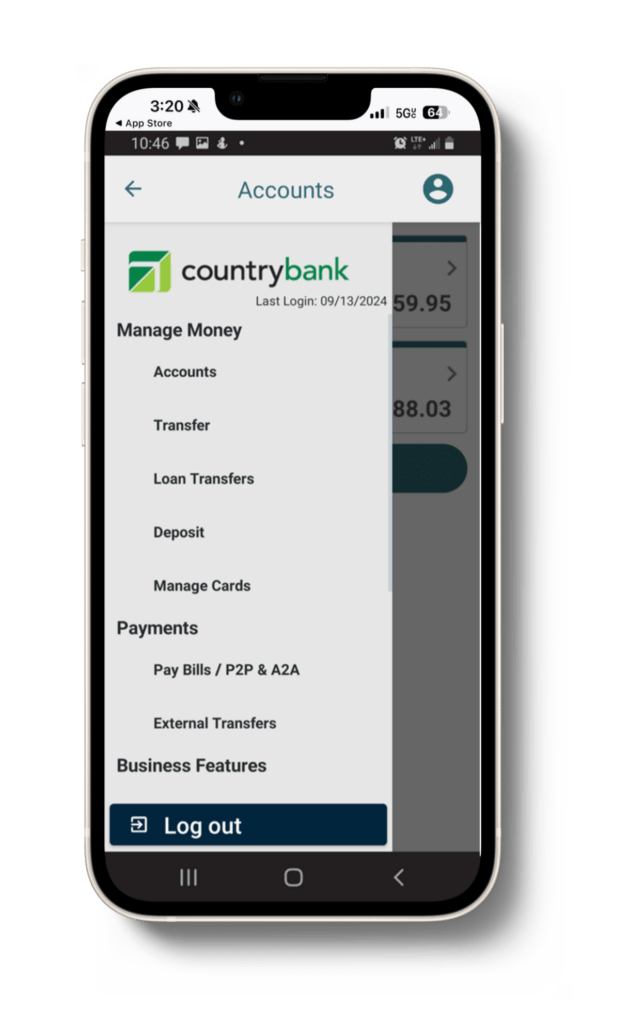

We strive to make life easier for those who put their blood, sweat, and tears into building something that makes our communities better. Explore these cash management options to save you time and simplify your finances.

As a business owner, it’s crucial to manage your finances wisely to ensure growth and stability. From budgeting effectively to investing in the right areas, every decision counts. Take advantage of these tools and tips to secure your business’s future.

Every deposit account at Country Bank is insured in full. In addition to Federal Deposit Insurance Corporation (FDIC) insurance, Country Bank offers Depositors Insurance Fund (DIF) protection.

Yes, you can pay your taxes through Cash Management or by signing up with EFTPS.

Check Positive Pay: Welcome to the most powerful tool available to combat check fraud. This service monitors each check presented and matches it to a list of known issued checks. If there is a question or discrepancy, we flag it and let you know.

ACH Positive Pay / Blocks and Filters:

This tool is made to help you fight fraud associated with electronic payments. It gives your business the ability to block all ACH debits and/or credits from posting to your company accounts to prevent ACH fraud—or to control the ACH debits that post to your account.

Contact us if you are interested in adding these services.

Remote deposit capture allows you to scan checks and transmit scanned images to Country Bank for posting and clearing from the comfort of your office. Checks can be scanned to create a digital deposit. This digital deposit is then transmitted over an encrypted internet connection to Country Bank for clearing and posting.

Yes, the cutoff time for each is 4:00 pm Monday through Friday (excluding Holidays.) This allows ample time for back office staff to approve and verify before end of day.

Experience the difference of exceptional service when you stop by a local banking center.

Review account balances and transactions for your business checking and business money market accounts.

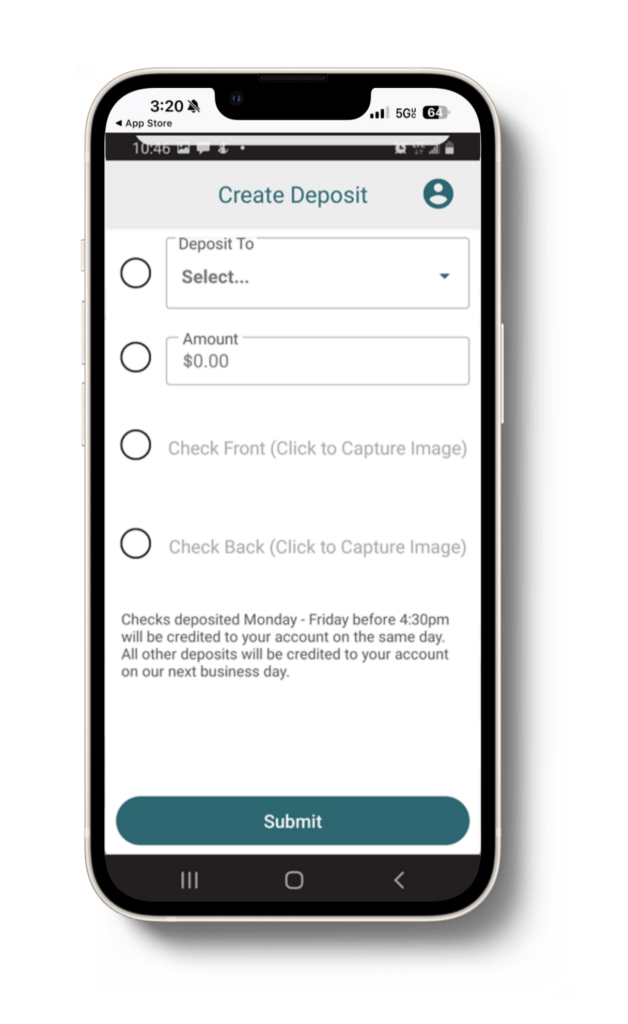

Easily deposit your business’s checks from your smartphone 24/7.

Manage your bills monthly or set recurring payments to stay on top of your business finances.