KASASA SAVER® SAVINGS ACCOUNT FEATURES

Automatic Transfers

Linking your Kasasa Saver® account to your Kasasa checking® account allows earnings to be automatically transferred from checking to savings so your money grows without you even thinking about it!

Convenient Access

Access your account 24/7 with free online banking and mobile banking or visit one of our local banking centers.

The Kasasa Saver® account is only available to Kasasa checking® account holders.

KASASA SAVER® ACCOUNT RATES

Rate Effective Date: April 16, 2025

| Specifications | Amount |

|---|---|

| Minimum opening deposit: | $10 |

| Minimum balance to obtain Annual Percentage Yield: | None |

| Daily balances of: Interest rate: Annual Percentage Yield (APY): | $0.00 – $100,000.00 0.75% 0.75% |

| Daily balances of: Interest rate: Annual Percentage Yield (APY): | $100,000.01 and up 0.10% 0.75% – 0.43% |

| Non-qualifying accounts* Interest rate: Annual Percentage Yield (APY): | 0.10% 0.10% |

The interest rate and annual percentage yield may change after account opening. Account Qualifications that must be met on the Kasasa Checking account (per qualification cycle): Have at least 12 debit card purchases post and settle; have at least one direct deposit, one automatic ACH transaction, or bill payment transaction post and settle; and be enrolled in and agree to receive eStatements. $10 minimum balance required to open account. Fees could reduce earnings on the account Limited to one account per SSN/TIN.

ENJOY EXCLUSIVE PERKS WITH EVERY COUNTRY BANK SAVINGS ACCOUNT

ATM Card

Link to a Mastercard® Debit Card

Online Banking

Mobile Banking with Free Mobile Deposit

Text Banking

eStatements

DISCOVER THE BEST SAVINGS ACCOUNT FOR YOUR NEEDS

| Feature | Kasasa Saver® | Statement Savings Account | 18/65 Savings Accounts | Choice Savings Accounts |

| Minimum Opening Balance | $10 | $10 | $10 | $10 |

| Minimum Balance to Earn Interest | N/A | $10 | $10 | $10 |

| Monthly Fee | $0 | $0 | $0 | $0 |

| Earns Interest | Yes | Yes | Yes | Yes |

| Reduced NSF Fees | No | No | Yes | No |

18/65 SAVINGS ACCOUNTS

As mandated by Massachusetts Law, customers 18 years of age and under or 65 years of age and older, are entitled to an account that is free of monthly service charges. Limited to one account per SSN/TIN.

SAFEGUARD YOUR IDENTITY WITH KASASA PROTECT™

Safeguard your identity and finances around the clock with Kasasa Protect. Enjoy affordable, 24/7 credit monitoring, credit report access, credit score tracker, dark web monitoring, lost wallet protection, identity restoration, and alerts for suspicious activity.

BANKING MADE SIMPLE

SAVINGS ACCOUNT RESOURCES

Take control of your finances with free savings account tools and resources.

Savings Accounts

Money Market Accounts

FINDING YOUR SOLUTION

SAVINGS ACCOUNT FAQs

Can I deposit money into my savings account at any Country Bank ATM/ITM?

Yes, at most of our ATM/ITM locations. The only location that cannot accept deposits is the Worcester Public Market.

How far back can I look at my account statements in online banking?

Currently, the system will allow you to retrieve the prior eighteen months of account statements. If you need information prior to that, please contact us at 800-322-8233 and our Customer Care Center would be delighted to assist you.

How are my deposits insured?

All deposits are insured through the combined coverage of the FDIC (Federal Deposit Insurance Corporation) and the DIF (Depositor’s Insurance Fund). Under the FDIC, the standard insurance amount is $250,000 per depositor, for each ownership category. As a depositor in this bank, all of your deposits and accrued interest are insured in full without limit or exception. All deposits above the FDIC limit are insured in full by the Depositors Insurance Fund.

There has been a lot in the news lately about deposit insurance and bank safety. This question and answer section is to provide you with useful information about the safety and security of your funds at Country Bank. You can be confident that Country Bank is in a strong financial position and your interests are safe. In fact, the deposits of Country Bank customers are backed by the Federal Deposit Insurance Corporation (FDIC) to the maximum extent allowed by law. Additionally, the Depositors Insurance Fund insures all deposit amounts above FDIC limits in full.

LEARN MORE: FDIC

LEARN MORE: DIF

The combination of FDIC and DIF insurance provides Country Bank customers with full deposit insurance on all their deposit accounts. If you need more information or would like to discuss your accounts, please visit any of our branches or contact our Customer Care Center at 800-322-8233.

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

SKIP THE TRIP

MOBILE BANKING

24/7 Access

Manage your accounts from the palm of your hand whenever it’s convenient for you.

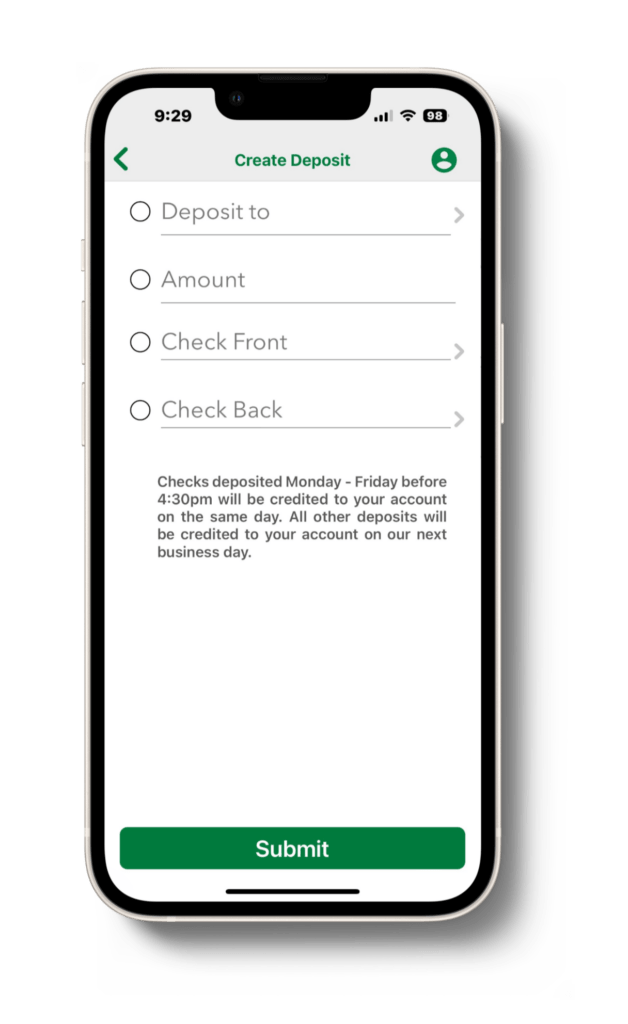

Mobile Deposit

Deposit checks with the snap of a photo.

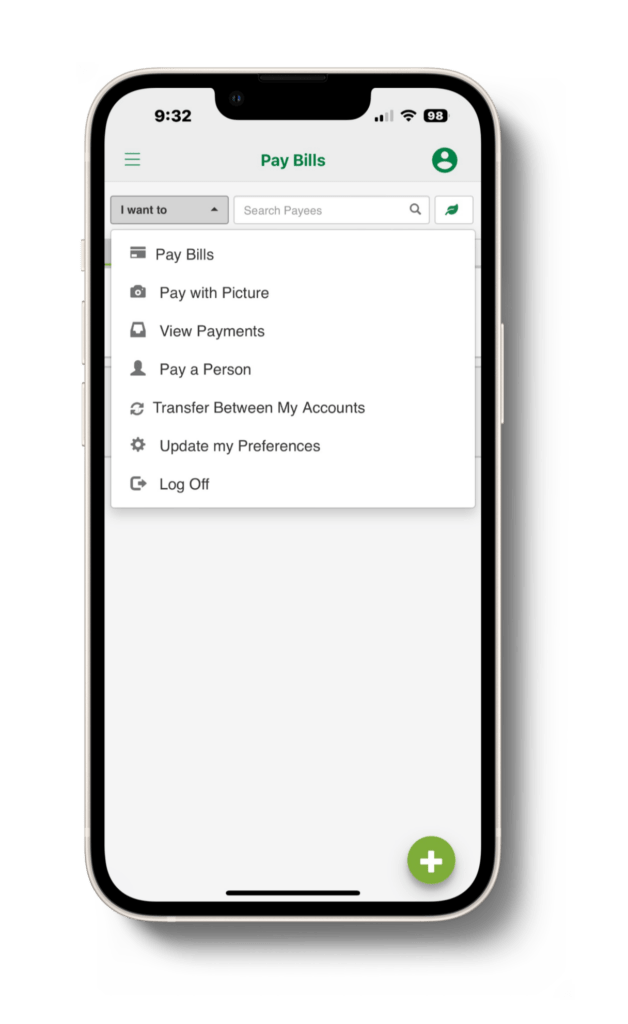

Transfer Money

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.