Justin Calheno

VICE PRESIDENT, RETAIL LENDING BUSINESS DEVELOPMENT OFFICER NMLS #5549 jcalheno@countrybank.com Direct Dial: 413-277-2370 Cell: 413-626-0395 Fax: 413-234-3243

APPLY NOW

Building or renovating your home should be exciting, not stressful! Let us help you simplify the process with financing you can count on. Our competitive construction loan rates and flexible terms help you create a custom financing option that fits your goals and budget.

| Product | Interest Rate | Points | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| 30 Year | 6.500% | 0 | 6.623% | $6.32 |

| 6.250% | 1 | 6.489% | $6.16 | |

| 6.000% | 2 | 6.355% | $6.00 | |

| 20 Year | 6.125% | 0 | 6.285% | $7.24 |

| 5.875% | 1 | 6.187% | $7.09 | |

| 5.625% | 2 | 6.090% | $6.95 | |

| 15 Year | 5.875% | 0 | 6.074% | $8.37 |

| 5.500% | 1 | 5.889% | $8.17 | |

| 5.125% | 2 | 5.703% | $7.97 | |

| 10 Year | 5.750% | 0 | 6.031% | $10.98 |

| 5.250% | 1 | 5.800% | $10.73 | |

| 4.875% | 2 | 5.696% | $10.55 |

| PRODUCT | INTEREST RATE | Points | CAPS* | ANNUAL PERCENTAGE RATE | MONTHLY PAYMENT PER $1,000 |

|---|---|---|---|---|---|

| 5/3 ARM (30 year) | 5.875% | 0 | 2% / 4% | 6.524% | $5.92 first five years (60 payments), $6.42after initial adjustment (300 payments)** |

| 7/3 ARM (30 year) | 6.000% | 0 | 2% / 4% | 6.484% | $6.00 first seven years (84 payments), $6.40after initial adjustment (276 payments)** |

| 10/1 ARM (30 year) | 6.250% | 0 | 2% / 4% | 6.540% | $6.16 first ten years (120 payments), $6.40after initial adjustment (240 payments)** |

Fixed Rate Disclosure:

Including Construction.

All Annual Percentage Rates (APR) listed below assume a $165,000 mortgage and a 20% down payment unless otherwise stated. Private Mortgage Insurance (PMI) required if the down payment is less than 20%.

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at anytime during the loan process (up until 10 days before the closing)

Mobile Homes with own land will be financed as 3/3 ARM, 5/3 ARM, 7/3 ARM or 10/1 ARM; 15 Year (180) amortization.

Adjustable Rate Disclosure:

Including construction. The annual percentage rate is subject to increase or decrease after closing. CAP Structure: Initial Adjustment/Lifetime Adjustment. The margin on all Adjustable Rate mortgages is 2.750% unless otherwise noted.

All Annual Percentage Rates (APR) listed below assume a $165,000 mortgage and a 20% down payment unless otherwise stated. Private Mortgage Insurance (PMI) required if the down payment is less than 20%.

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at anytime during the loan process (up until 10 days before the closing)

Mobile Homes with own land will be financed as 3/3 ARM, 5/3 ARM, 7/3 ARM or 10/1 ARM; 15 Year (180 months) amortization.

Building your dream home has never been more affordable! Take advantage of our competitive construction loan rates and finance up to 90%1 of everything from the foundation to the finishing touches! Even better, only pay interest during the first 12 months!

Flexibility makes a difference! Select an adjustable-rate construction loan or a fixed-rate construction loan depending on your ideal rate and repayment schedule.

You do many hard things in life, buying your home shouldn’t be one of them. Our mortgage experts will guide you every step of the way so you are well-prepared and set up for financial success.

This calculator is for informational purposes only and its use does not guarantee an extension of credit. Your actual term and payment will be provided upon acceptance of a Country Bank Loan.

Construction loans cover up to 90%1 of the total cost of building a home as well as the cost of land, labor, materials, and permits. Once you are approved, you can access the money you need alongside each phase of the construction directly through your Country Bank checking account. When the home or major renovations are complete, your construction loan will be converted into a traditional mortgage and you’ll begin making payments on the principal and interest. Sound like the right option for your needs? Apply now using our easy application or contact our experienced mortgage experts today with any questions.

Not finding your ideal home in Massachusetts? No problem! Bring your vision to life with a construction loan through Country Bank. Applying for a construction loan is easy! Check out what you can expect throughout the process:

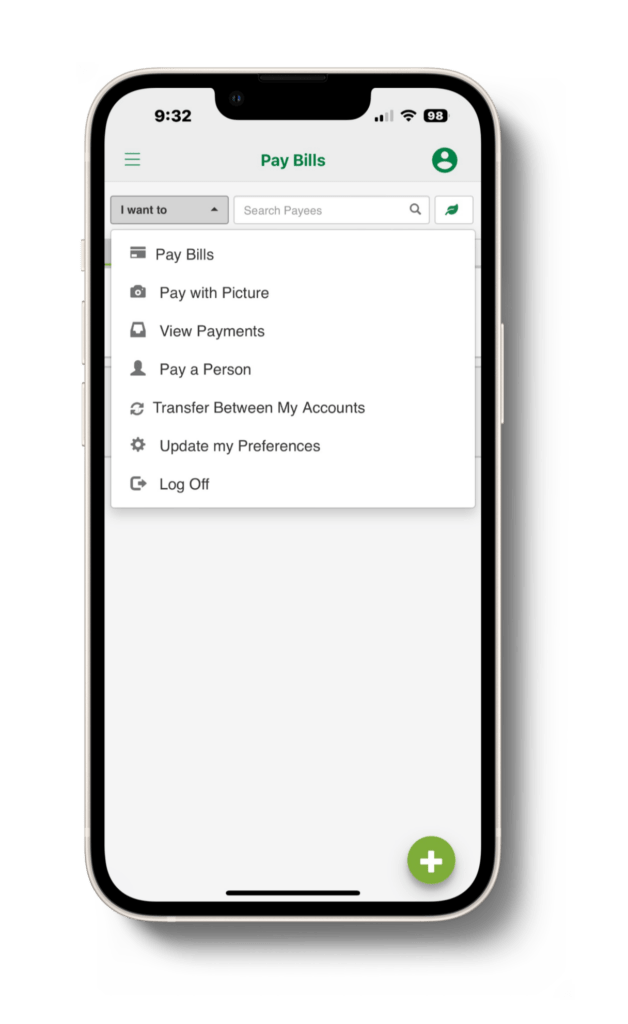

Finalize your application with Country Bank and manage your money easily with our state-of-the-art Construct portal. Inside this portal you can monitor your project progress in real time, order inspections as needed, check your loan balance, collaborate with your builder, and get things done faster! If you are unsure if a construction loan is right for your project, please get in touch with one of our experienced mortgage experts today.

When you’re applying for a mortgage, it’s important to have someone you trust at your side. We’re experts at walking you through the entire process, answering your questions, and cheering you on to success. It’s what we’re made to do.

VICE PRESIDENT, RETAIL LENDING BUSINESS DEVELOPMENT OFFICER NMLS #5549 jcalheno@countrybank.com Direct Dial: 413-277-2370 Cell: 413-626-0395 Fax: 413-234-3243

APPLY NOW

RETAIL LOAN OFFICER NMLS #432695 jsoucia@countrybank.com Direct Dial: 413-277-2348 Cell: 413-262-2141 Fax: 866-757-5784

APPLY NOW

RETAIL LOAN OFFICER NMLS #618959 jvelez@countrybank.com Direct Dial: 413-277-2318 Cell: 413-636-2925 Fax: 866-506-7515

APPLY NOW

RETAIL LOAN OFFICER NMLS #432698 kkemp@countrybank.com Direct Dial: 413-277-2383 Cell: 774-200-5017 Fax: 866-726-4071

APPLY NOW

RETAIL LOAN OFFICER

NMLS #689658

lsanchez@countrybank.com

Direct Dial: 413-277-2041

Cell: 413-209-4823

Bilingual – English & Spanish

Servicio en Español

Take control of your future finances and set yourself up for success by making informed mortgage choices today.

Borrowing money makes it possible to afford things that you couldn’t otherwise, but make sure you understand what you’re signing […]

Read More

Making payments on a loan with suboptimal terms can make you feel trapped. Luckily, refinancing can help you find more […]

Read More

If you’ve ever financed a car or taken out a mortgage, you’ve likely heard the word “amortization” tossed around. It’s […]

Read MoreWe have you covered! Here is the information you’ll need when you are ready to apply for a mortgage.

STEP 1: GET PRE-QUALIFIED TO MAKE YOUR PURCHASE

Fill out a mortgage application for a prequalification. As part of this process we will obtain your credit report and request income documentation. We will then determine the amount you would be approved for and issue a prequalification letter. This letter can be used to put in an offer on a home.

STEP 2: APPLYING FOR YOUR MORTGAGE LOAN

If you are purchasing a property, you will want to contact your loan officer to get your mortgage application started and submitted once an offer is accepted. If you already own the property than simply reach out to a loan officer to get the mortgage application started and submitted.

STEP 3: REVIEW LOAN ESTIMATE

Once we have received and processed your submitted mortgage application, you will receive your initial loan disclosure paperwork which includes your loan estimate (a breakdown of potential closing costs associated with your transaction).

STEP 4: PROPERTY APPRAISAL

Once you have reviewed your initial disclosure package and signed your intent to proceed. The appraisal fee will be collected and your appraisal will be ordered. The property will be appraised to establish its current market value.

STEP 5: UNDERWRITING PROCESS

The Loan Processor will submit your paperwork to a Residential Mortgage Underwriter who will underwrite this file to secondary market guidelines.

STEP 6: LOAN APPROVAL PACKAGE

After underwriting has approved your mortgage, the loan approval package will be sent out to you. Typically, this package will contain any outstanding loan conditions that are needed before the closing can be scheduled with the attorney. Once underwriting has received and reviewed the outstanding conditions, the loan will be cleared to close. At that point you will begin to work on scheduling the closing with your attorney. At least three days before your closing, you will receive your initial closing disclosure. This is a very important document as it breaks down the amount needed to bring to the closing.

STEP 7: CLOSING

The “closing” is the last step in buying and financing a home. This is when you and all the other parties in a mortgage loan transaction sign the necessary documents. Before you sign, make sure you carefully read and understand all the loan documents.

Credit requirements are dependent on many different factors, including the loan program applied for. If you are unsure of how your credit history will affect your application, please contact one of our loan officers who will discuss options with you.

Closing costs are the fees you pay to complete your loan; they include but are not limited to origination fee, title insurance, prepaid escrows, and more. Closing costs will vary depending on many different factors including the loan program applied for, down payment, etc. Your loan officer will provide you with a loan estimate that will break down expected closing costs.

DISCLOSURES:

Private Mortgage Insurance (PMI) required if the down payment is less than 20%.

1 If using a Licensed General Contractor, Country Bank will finance up to 90% of the appraised value of the property. If operating as your own General Contractor, Country Bank will finance up to 80% of the final value of the property.

Experience the difference of exceptional service when you stop by a local banking center.

FIND LOCATIONS

Knowing where your current mortgage stands can help you manage refinancing possibilities in the future.

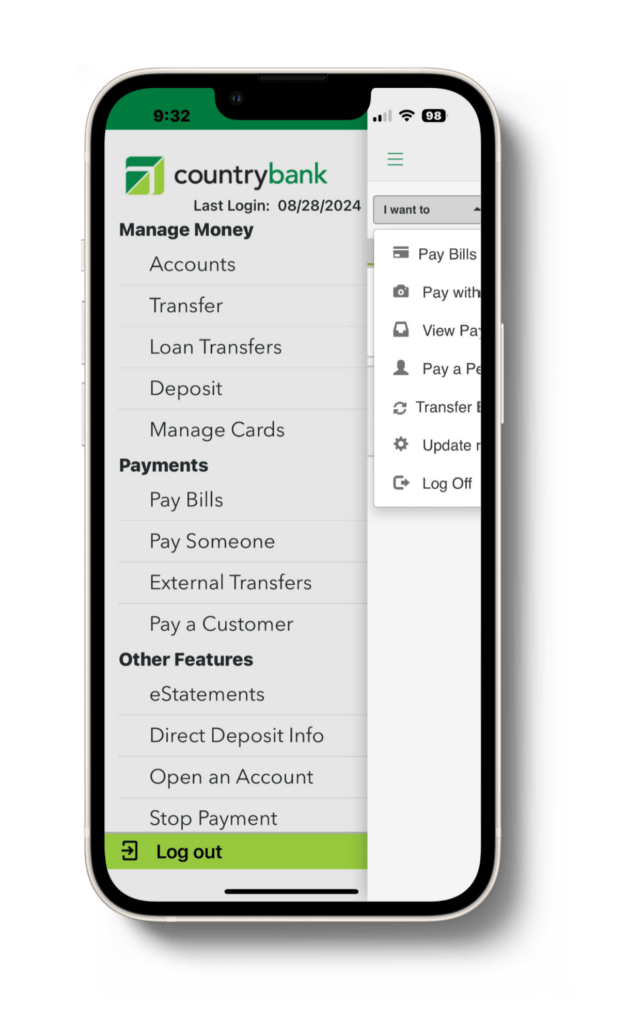

In just a few taps, you can pay your mortgage or even set up a recurring payment so you can focus on what matters most.

Make an extra principal-only payment on your mortgage so you can pay your loan off faster.