MONEY MARKET ACCOUNT FEATURES

Easy Access

Access your funds when you need them with the ability to write checks from your money market account.

Higher Earnings

Supercharge your savings with higher earning potential and competitive rates.

Low Minimums

Open a money market account with $1,000 and keep earning with just a $10 minimum balance.

EMPOWER YOUR SAVINGS

MONEY MARKET RATES

Get rewarded for your ability to save and grow your wealth with competitive money market rates. Enjoy the perfect balance of high returns, low risk, and easy access.

Rate Effective Date: April 18, 2025

| Specifications | Amount / Rates |

|---|---|

| Daily balances of: Interest rate: Annual Percentage Yield (APY) | $10.00 – $999.99 0.05% 0.05% |

| Daily balances of: Interest rate: Annual Percentage Yield (APY) | $1,000 – $9,999.99 0.10% 0.10% |

| Daily balances of: Interest rate: Annual Percentage Yield (APY) | $10,000 – $49,999.99 0.15% 0.15% |

| Daily balances of: Interest rate: Annual Percentage Yield (APY) | $50,000 – $99,999.99 0.25% 0.25% |

| Daily balances of: Interest rate: Annual Percentage Yield (APY) | $100,000.00 and above 0.35% 0.35% |

The rate may change after the account is opened. Fees could reduce earnings on the account

ENJOY EXCLUSIVE PERKS WITH EVERY COUNTRY BANK SAVINGS ACCOUNT

ATM Card

Link to a Mastercard® Debit Card

Online Banking

Mobile Banking with Free Mobile Deposit

Text Banking

eStatements

DISCOVER THE BEST ACCOUNT FOR YOUR MONEY

| FEATURE | MONEY MARKET | CD* | Kasasa Saver®** | Statement Savings Account** |

| Minimum Opening Balance | $1000 | $500 | $10 | $10 |

| Minimum Balance to Earn Interest | $10 | $500 | $0 | $10 |

*A minimum deposit of $500.00 is required to open this account. No withdrawals are permitted within the first six (6) days after the date of deposit. A penalty will be imposed for early withdrawal. This account cannot be linked to a Mastercard debit card.

**A minimum deposit of $10.00 is required to open this account.

The rate may change after the account is opened, apart from the Certificate of Deposit (CD) account. Fees may reduce earnings on all accounts.

WHAT IS A MONEY MARKET ACCOUNT?

A money market account is a deposit account that blends the high-yield benefits of a savings account with the convenient access of a checking account. Money market accounts offer the perfect balance of high earnings, easy access, and low risk. Money market savings accounts are a great solution if you’re looking to grow your funds through secure investments without limiting access to your funds.

We’d love to help you discover if a money market account is the right choice for you. Contact Country Bank to chat with a member of our team or apply online if you’re ready to open a money market account today!

BANKING MADE SIMPLE

SAVINGS AND MONEY MARKET RESOURCES

Grow your savings with free tools and resources on personal finance.

Savings Accounts

Money Market Accounts

FINDING YOUR SOLUTION

MONEY MARKET FAQs

How far back can I look at my account statements in online banking?

Currently, the system will allow you to retrieve the prior eighteen months of account statements. If you need information prior to that, please contact us at 800-322-8233 and our Customer Care Center would be delighted to assist you.

How are my deposits insured?

All deposits are insured through the combined coverage of the FDIC (Federal Deposit Insurance Corporation) and the DIF (Depositor’s Insurance Fund). Under the FDIC, the standard insurance amount is $250,000 per depositor, for each ownership category. As a depositor in this bank, all of your deposits and accrued interest are insured in full without limit or exception. All deposits above the FDIC limit are insured in full by the Depositors Insurance Fund.

There has been a lot in the news lately about deposit insurance and bank safety. This question and answer section is to provide you with useful information about the safety and security of your funds at Country Bank. You can be confident that Country Bank is in a strong financial position and your interests are safe. In fact, the deposits of Country Bank customers are backed by the Federal Deposit Insurance Corporation (FDIC) to the maximum extent allowed by law. Additionally, the Depositors Insurance Fund insures all deposit amounts above FDIC limits in full.

LEARN MORE: FDIC

LEARN MORE: DIF

The combination of FDIC and DIF insurance provides Country Bank customers with full deposit insurance on all their deposit accounts. If you need more information or would like to discuss your accounts, please visit any of our branches or contact our Customer Care Center at 800-322-8233.

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

SKIP THE TRIP

MOBILE BANKING

24/7 Access

Manage your accounts from the palm of your hand whenever it’s convenient for you.

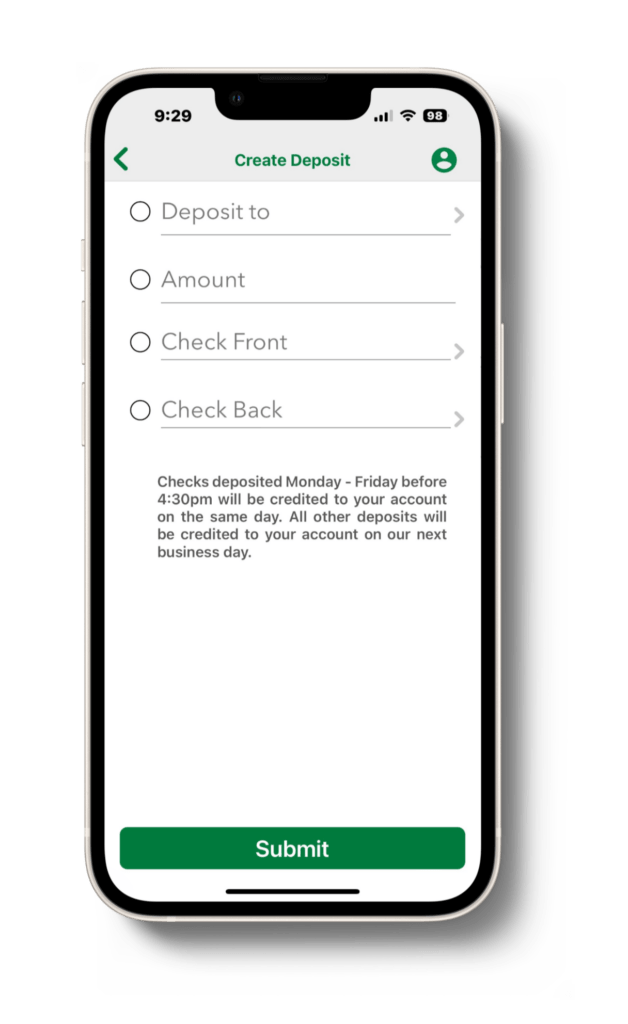

Mobile Deposit

Deposit checks with the snap of a photo.

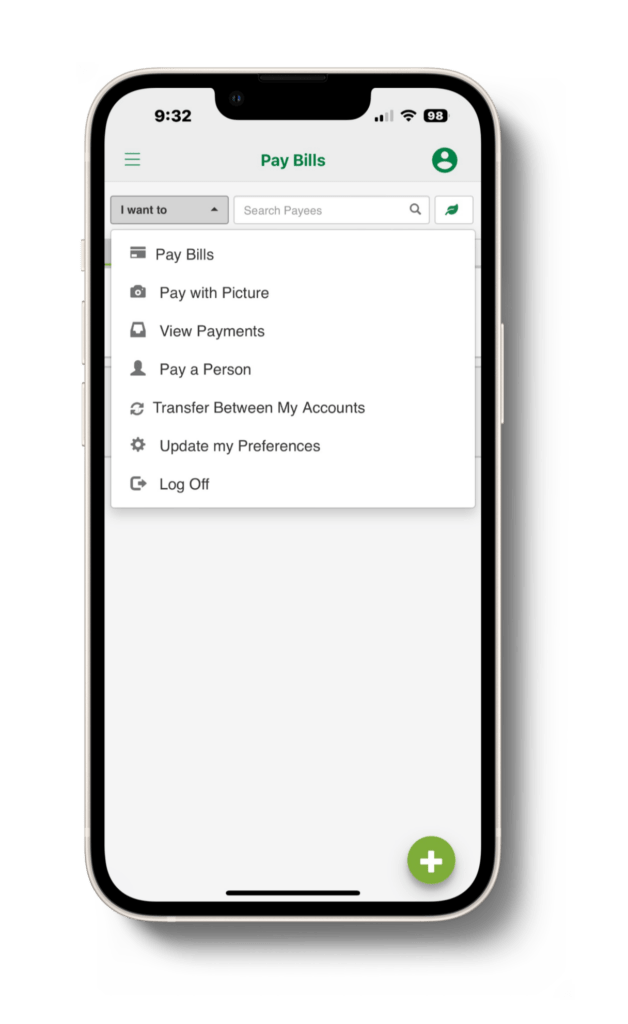

Transfer Money

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.