LETTER OF CREDIT

WHAT IS A LETTER OF CREDIT?

A Letter of Credit is a type of legal agreement that creates a guarantee of payment and is often required by municipalities with financial or performance obligations. For instance, for major buildout, infrastructure, or renovation projects.

Contact us today to see how we can assist you with this assurance with your next project.

EMPOWER YOUR FUTURE

COMMERCIAL BANKING RESOURCES

As a business owner, it’s crucial to manage your finances wisely to ensure growth and stability. From budgeting effectively to investing in the right areas, every decision counts. Take advantage of these tools and tips to secure your business’s future.

Support Small Business Saturday, November 30th: A Celebration of Local Entrepreneurs

Professional Help With Your Business

FINDING YOUR SOLUTION

COMMERCIAL LETTER OF CREDIT FAQs

Are my business accounts insured?

Every deposit account at Country Bank is insured in full. In addition to Federal Deposit Insurance Corporation (FDIC) insurance, Country Bank offers Depositors Insurance Fund (DIF) protection.

- The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

- All deposits above the FDIC limits are insured in full by the DIF

- The combination of FDIC and DIF insurance provides customers of Massachusetts-chartered savings banks with full deposit insurance on all of their deposit accounts

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

BUSINESS BANKING SIMPLIFIED

MOBILE BANKING

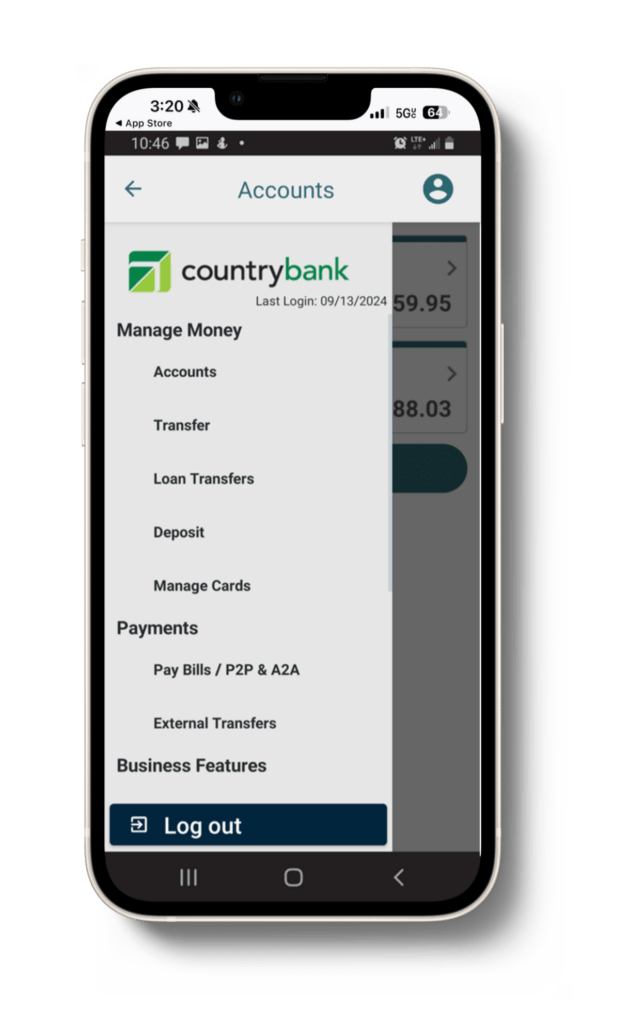

Monitor Your Accounts

Review account balances and transactions for your business checking and business money market accounts.

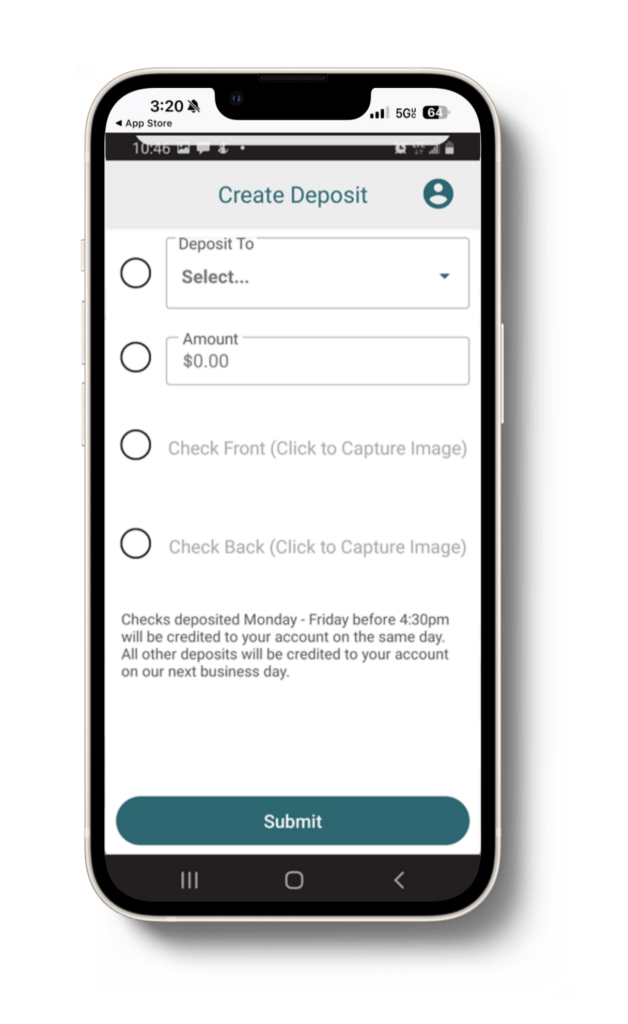

Deposit Checks

Easily deposit your business’s checks from your smartphone 24/7.

Pay Bills

Manage your bills monthly or set recurring payments to stay on top of your business finances.