Teaching Children About Money

Whether you’re teaching finances to your kids, your grandkids, or those of a loved one, it’s absolutely essential to teach […]

Read More

Enjoy a break on taxes either when you contribute or when you withdraw depending on the IRA you choose.

Reach your retirement goals faster with higher returns than most saving solutions.

| Feature | roth iRA | TRADITIONAL IRA | SEP IRA |

| Tax Deductible Contributions | NO | YES | YES |

| Tax-Advantaged Withdrawals | YES | NO | NO |

| Tax-Advantaged Growth | YES | NO | NO |

| Employer Contributions | NO | NO | YES |

A Traditional IRA is a special tax-deferred savings account in which earnings are not taxed until you begin to withdraw from it. A traditional IRA allows for tax-deductible contributions for most people.

A Roth IRA is a retirement solution that allows you to contribute after-tax dollars. While there are no tax deductions for your contributions, your withdrawals and earnings are not taxed as long after age 59 ½ if your account has been open for at least five years.

It’s never too early to start planning for retirement. You can contribute to a Roth IRA at any age. If you meet the modified adjusted gross income requirements. Explore maximum contribution amounts and tax advantages or if you’re ready to open an account, apply online today!

A SEP IRA is a written agreement under which an employer contributes money to their employees’ Traditional/SEP IRA. Once funds are contributed, it becomes the responsibility of the employee to manage their IRA investments. This is a great choice for an employer or self-employed person looking for an inexpensive and easy-to-administer retirement plan.

| Terms | Interest Rate | Annual Percentage Yield (APY) |

|---|---|---|

| 3-Month (91 Days) $500.00-25,000.00 | 0.10% | 0.10% |

| 3-Month (91 Days) $25,000.01-49,999.99 | 0.10% | 0.10% |

| 3-Month (91 Days) $50,000 and up | 0.10% | 0.10% |

| *SPECIAL: 5-Month Add-On CD | 4.50% | 4.60% |

| 6-Month (182 Days) | 0.10% | 0.10% |

| 9-Month (273 Days) | 0.40% | 0.40% |

| 1-Year | 3.50% | 3.56% |

| 2-Year | 3.25% | 3.30% |

| 3-Year | 3.00% | 3.04% |

| 4-Year | 3.00% | 3.04% |

| 5-Year | 3.00% | 3.04% |

Minimum balance to earn the Annual Percentage Yield (APY) is $500. No withdrawals permitted within the first six (6) days after the date of deposit. A penalty will be imposed for early withdrawal. Fees could reduce earnings on the account.

The 5 Month Add On Certificate of Deposit Special is available as of 12/09/2024. This CD requires a minimum deposit of $500 to open and earn interest. New money is required to open this account, and is considered as any funds not currently on deposit with Country Bank. Allowance of additional deposits granted throughout the term of the CD, and ceases upon renewal. Additional deposits must be made with $1,000 or more in new money. This offer is not available for IRA accounts or Municipalities. The Annual Percentage Yield (APY) is effective as of 12/09/2024. Fees may reduce earnings on these accounts. A penalty will be imposed for early withdrawal. No withdrawals are permitted within the first six (6) days after the date of deposit. This is a limited time offer; it may be withdrawn any time.

Start your journey to retirement today. Calculate your retirement contributions and compare account options with free retirement savings calculators.

Build your nest egg with retirement solutions tailored to your needs.

Whether you’re teaching finances to your kids, your grandkids, or those of a loved one, it’s absolutely essential to teach […]

Read More

Getting Interested With a savings account, you earn interest, or a percentage of your balance, on the money in your […]

Read More

There are many options for keeping your money safe and earning a little extra from interest. Like a savings account […]

Read MoreAll deposits are insured through the combined coverage of the FDIC (Federal Deposit Insurance Corporation) and the DIF (Depositor’s Insurance Fund). Under the FDIC, the standard insurance amount is $250,000 per depositor, for each ownership category. As a depositor in this bank, all of your deposits and accrued interest are insured in full without limit or exception. All deposits above the FDIC limit are insured in full by the Depositors Insurance Fund.

There has been a lot in the news lately about deposit insurance and bank safety. This question and answer section is to provide you with useful information about the safety and security of your funds at Country Bank. You can be confident that Country Bank is in a strong financial position and your interests are safe. In fact, the deposits of Country Bank customers are backed by the Federal Deposit Insurance Corporation (FDIC) to the maximum extent allowed by law. Additionally, the Depositors Insurance Fund insures all deposit amounts above FDIC limits in full.

LEARN MORE: FDIC

LEARN MORE: DIF

The combination of FDIC and DIF insurance provides Country Bank customers with full deposit insurance on all their deposit accounts. If you need more information or would like to discuss your accounts, please visit any of our branches or contact our Customer Care Center at 800-322-8233.

No. While there are other “excess” deposit insuring entities, only Massachusetts chartered savings banks (and one federal savings bank) provide the additional protection of DIF insurance. For additional information visit the DIF website.

No depositor has ever lost any money in a bank insured by both the FDIC and the DIF. The DIF has more than $300 million dollars in assets, plus an additional $100 million of reinsurance.

Experience the difference of exceptional service when you stop by a local banking center.

FIND LOCATIONS

Manage your accounts from the palm of your hand whenever it’s convenient for you.

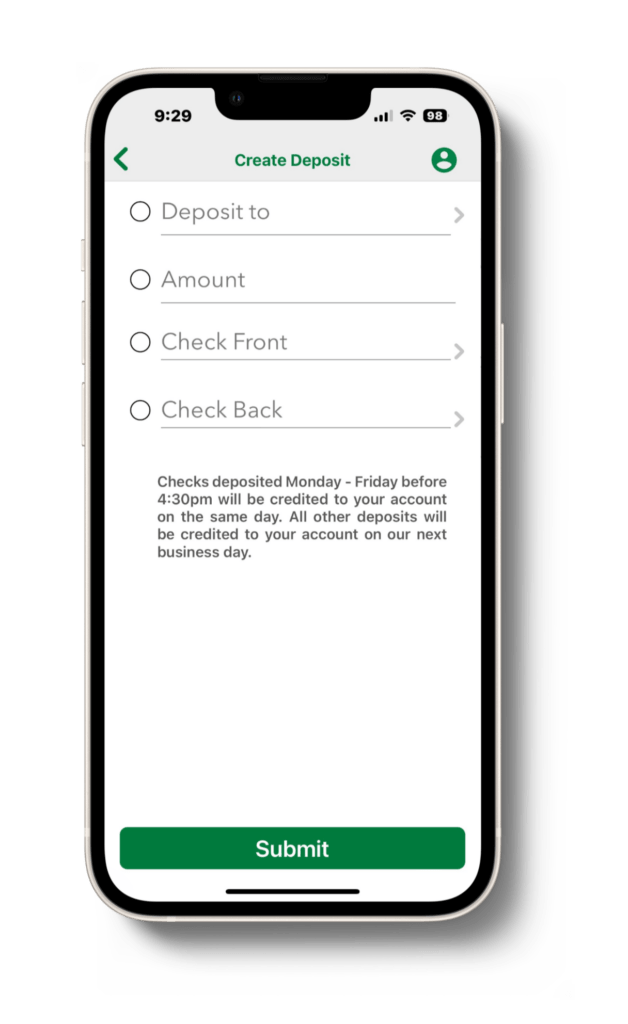

Deposit checks with the snap of a photo.

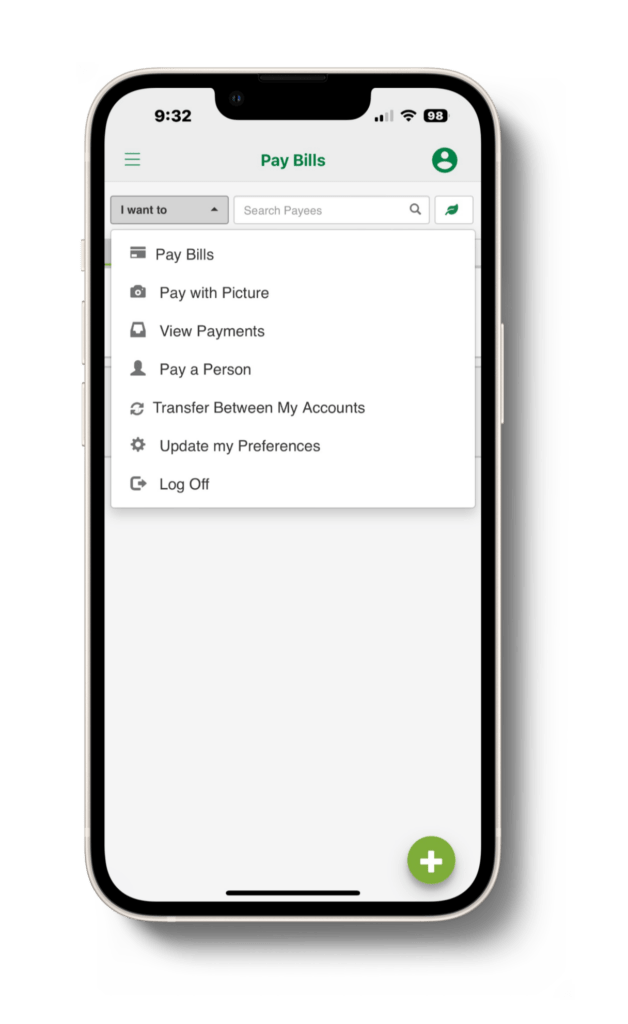

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.