24/7 Monitoring

With Kasasa Protect™, you get affordable, 24/7 credit monitoring, credit reporting, and access to a monthly credit score tracker.

Please remember that a legitimate business or your bank will never ask you to provide your bank passwords, ATM/Debit card pins, or account log-in information.

With Kasasa Protect™, you get affordable, 24/7 credit monitoring, credit reporting, and access to a monthly credit score tracker.

Contact us immediately at 800-322-8233 or Fraudhotline@countrybank.com

Take a closer look at Kasasa’s features or Kasasa Protect today by calling us at 800-322-8233, or visiting one of our banking centers.

Identity theft is a serious crime, and it’s on the rise. People whose identities have been stolen can spend months or years – and thousands of dollars – cleaning up the mess.

Be sure to review financial account and billing statements regularly, looking for charges you did not make. Inspect your credit reports for accuracy and immediately report errors. You are entitled by law to receive one free credit report from each of the three credit bureaus every 12 months. For more information regarding your free credit report, visit www.annualcreditreport.com.

If you suspect your identity has been used fraudulently, visit www.identitytheft.gov for a free customized recovery plan.

Scammers use every trick in their communication arsenal to steal your identity, personal financial information, money, and more. Protect your computer systems from intrusions that could lead to loss or theft of data or software.

Please remember that a legitimate business or your bank will never ask you to provide your bank passwords, ATM/Debit card pins, or account log-in information.

Use complex passwords – Utilizing passwords that are a mixture of numbers, letters, and symbols works best. Avoid using dictionary words or names. It is recommended that you use a unique password for each of your sites and programs.

Have an Anti-Virus – Install system patches and perform virus scans regularly. Even better- set your system to update automatically so you don’t have to remember.

Beware of Social Engineering – Don’t click suspicious links or attachments received in emails. Those files or malicious websites could infect your system with malware. The same goes for any pop-up windows that tell you your computer is infected with a virus. By clicking on that pop-up, you’re actually downloading the virus.

Back up your data – If your systems are compromised, you’ll be glad you have your data backed up on another device or server.

For the latest internet security news and helpful videos, visit www.consumerreports.org. For the latest internet security news, helpful videos, and how to avoid or report a scam, please visit https://www.ftc.gov

Elder financial exploitation is the illegal or improper use of an elder’s resources by a family member, friend, neighbor, acquaintance, or stranger. Some studies estimate financial abuse and fraud can cost older Americans $36.5 billion per year.

To make a confidential report of the suspected abuse of an elder in the State of Massachusetts, contact the Elder Abuse Hotline at 1-800-922-2275 or visit www.mass.gov.

Elder Abuse – Protect yourself from scams

Beware of scams targeting your personal and financial information. Fraudsters use publicly available information and trending news to trick you into thinking they are a legitimate business, charity, government agency, or even someone you know. Two common red flags for scams are urgency and secrecy. A scammer will try to convince you to make a decision quickly without allowing you time to discuss it with others who may catch on to their rouse.

| Received by | notify | website | telephone number |

| Office of the Attorney General Postal Inspector | mass.gov postalinspectors.uspis.gov | 617-727-8400 1-877-876-2455 | |

| Telephone | Office of the Attorney General Federal Trade Commission | mass.gov ftc.gov | 617-727-8400 202-326-2222 |

| Internet | Office of the Attorney General | mass.gov ic3.gov ftc.gov/faq | 617-727-8400 202-326-2222 |

United States Postal Inspection Service – Report theft or fraud through the USPS.

National Do Not Call Registry – Register for the Do-Not-Call list.

Opt Out of Credit or Insurance Offers – Opt out of receiving credit and insurance offers.

Federal Trade Commission – Receive consumer protection information or report ID theft and fraud.

Office of the Attorney General Commonwealth of Massachusetts – File a consumer dispute against a business or get information on affordable housing, health and social services, unclaimed property and more.

FBI Internet Crime Complaint Center – Report a complaint regarding internet crime. If you or someone you know is age 60 or older and has encountered financial fraud, experienced professionals are standing by at the National Elder Fraud Hotline at 1-833-FRAUD-11 (1-833-372-8311)

Corporate Account Takeover is a type of business identity theft in which a criminal entity steals a business’s valid online banking credentials. Small to mid-sized businesses remain the primary target of criminals, but any business can fall victim to these crimes. Attacks today are typically perpetrated quietly by the introduction of malware through a simple email or infected website.

The Bank’s ability to protect you is severely undermined when your online credentials are compromised by a data breach initiated within your computer system. Once your computer is compromised, any action you can take from your online banking, a criminal will attempt to do fraudulently. For example: Bill Pay, ACH Transfers, Wires, copies of checks and signatures, etc. Any possible way to financially defraud you will not be overlooked by smart criminals with the intent to steal your money or personal information.

Hackers often take aim at small business’ computers because they are easier to infiltrate than banks’ systems.

Once the employee opens the attachment or goes to the website, malware is installed on the computer. In each case, fraudsters exploit the infected system to obtain security credentials that they can use to access a company’s business accounts. Once embedded, it can even seek out others within the network to gain secondary access or credentials. While up-to-date antivirus software offers substantial protection against malware, it isn’t 100% effective. According to the FBI, there is no single deterrent that is 100% effective against fraud, viruses, and malware.

Protecting your finances and knowing how to recover from identity theft and fraud is critical. Take advantage of these tools and tips to stay one step ahead and secure your financial future.

Experience the difference of exceptional service when you stop by a local banking center.

Manage your accounts from the palm of your hand whenever it’s convenient for you.

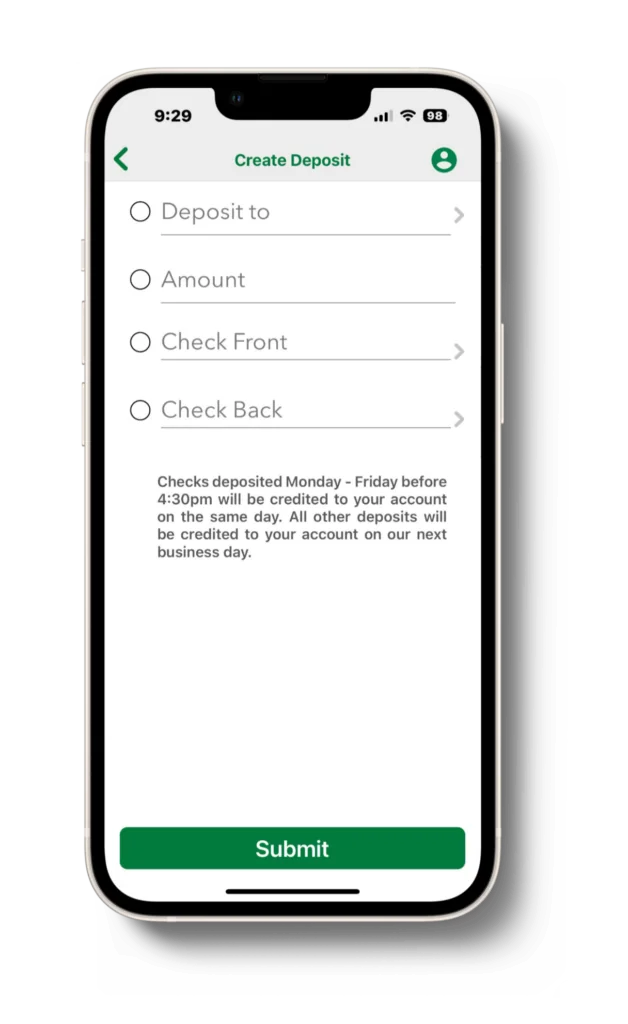

Deposit checks with the snap of a photo.

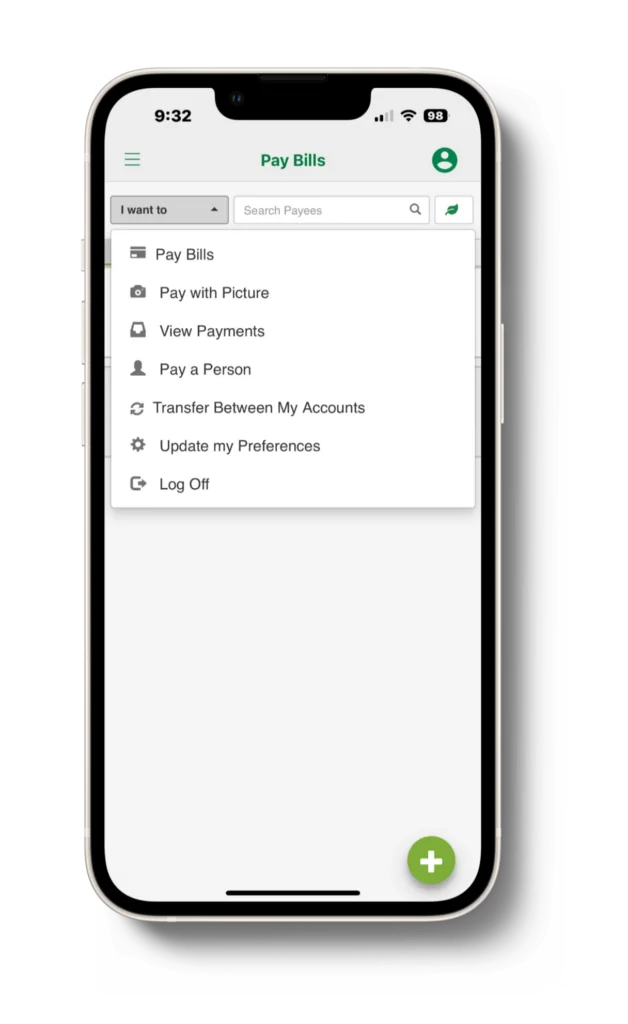

Easily transfer money between your accounts or over to a friend or family member straight from the Mobile App.