CREDIT BOOSTER LOAN

INVEST IN BUILDING OR IMPROVING YOUR CREDIT SCORE ONE STEP AT A TIME

YOUR PATH TO BETTER CREDIT STARTS HERE

CREDIT BOOSTER LOAN RATES

Our affordable Credit Booster Loan rates make big changes possible. Take the next step toward financial success by establishing a solid credit score through good habits and consistent, timely payments.

Rate Effective Date: April 16, 2025

| Product | Term | Interest Rate | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| Credit Booster | 36 Months | 7.500% | 7.500% | $31.11 |

Credit Booster Minimum $200.00 Max $3,000.00.

Minimum term: 12 months

All rates are subject to change without notice.

All loans are subject to credit approval.

If payment is automatically deducted from a new or existing Country Bank checking or savings account, the rate will be reduced by 0.250 percentage points. New accounts must be opened prior to closing.

CREDIT BOOSTER LOAN FEATURES

Repair or Establish Credit

Improve your credit score or build credit from scratch each time you make on-time payments.

Save More

Reduce your Credit Booster Loan interest rate by 0.250 percent when you set up automatic deduction from your new or existing Country Bank checking account or savings account.

Which payment fits you best?

Credit Booster Loan Calculator

This calculator is for informational purposes only and its use does not guarantee an extension of credit. Your actual term and payment will be provided upon acceptance of a Country Bank Loan.

WHAT IS A CREDIT BOOSTER LOAN?

A good credit score takes you far in life. If you just turned 18, it is time to establish a positive credit score and good financial habits. If you made some mistakes along the way and need to repair and improve your credit score, there is still hope! Both of these situations may be improved with a credit booster loan.

Here’s how it works: Once your Credit Booster Loan is approved, the money is deposited into a Country Bank savings account. A hold is placed on the account for the loan amount which means you can’t access the money. As you make payments on the loan balance, the funds will become available. If all payments are made on time, you will receive an interest credit incentive up to a maximum of $50 at the end of the loan term.

Have peace of mind that this second chance banking option may help you build credit and repair your credit score.

A LOAN that may establish or rebuild your credit

Instead of getting further into debt, it is time to take action and repair your credit score. Country Bank is ready to take this journey with you. Our Credit Booster Loan is a great option that may help you rebuild your credit. It minimizes the risk of further mistakes and creates safe boundaries to help you get your credit score back on track.

It’s important to make the payments on time. We can make this a little easier for you by setting up auto-pay so your payment comes directly out of your account every month when it is due. You just need to be sure you have enough money in your account to make the payment. New accounts must be opened prior to loan closing

Disclosure: If payment is automatically deducted from a Country Bank checking or savings account, the interest rate will be reduced by 0.250 percentage interest points. New accounts must be opened prior to closing.

HOW TO BUILD CREDIT

A good credit score makes a major difference when it comes to living your best life! Building credit is essential for securing loans, mortgages, and even renting an apartment. The better your score, the better rates you’ll receive which all boils down to more savings. Here are five tips to help you build credit effectively:

- Keep Your Credit Utilization Low: Credit utilization is the ratio of your credit card balances to your credit limits. Try to keep this ratio below 30%. Consistently pay off your balances.

- Diversify Your Credit Mix: Having a mix of credit accounts (credit cards, installment loans, retail accounts) can be beneficial for your credit score.

- Monitor Your Credit Report: Regularly check for errors and dispute inaccuracies.

- Pay Your Bills On Time and In Full: If you don’t have the money to spend right now, don’t place the balances on your credit cards. If you do have a credit card balance, pay it on time and in full each month.

A Credit Booster Loan may help you establish credit and take steps to repair your credit score. If you are ready to make on-time payments, apply today and take the first step towards a stronger credit score and better future!

EMPOWER YOUR FUTURE

CREDIT Booster LOAN RESOURCES

Making smart choices with money can make a major difference in your life. Take advantage of these tools and tips to stay one step ahead and secure your financial future.

Using Credit

Refinancing Loans

FINDING YOUR SOLUTION

CREDIT Booster LOAN FAQS

How old do I have to be to apply for a Credit Booster loan?

You must be 18 years or older to apply for this loan.

What are the minimum loan proceeds for a Credit Booster loan?

The minimum loan proceeds for a Credit Booster loan is $200.

What are the maximum loan proceeds for a Credit Booster loan?

The maximum loan proceeds for a Credit Booster loan is $3,000.

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

BANK SMARTER

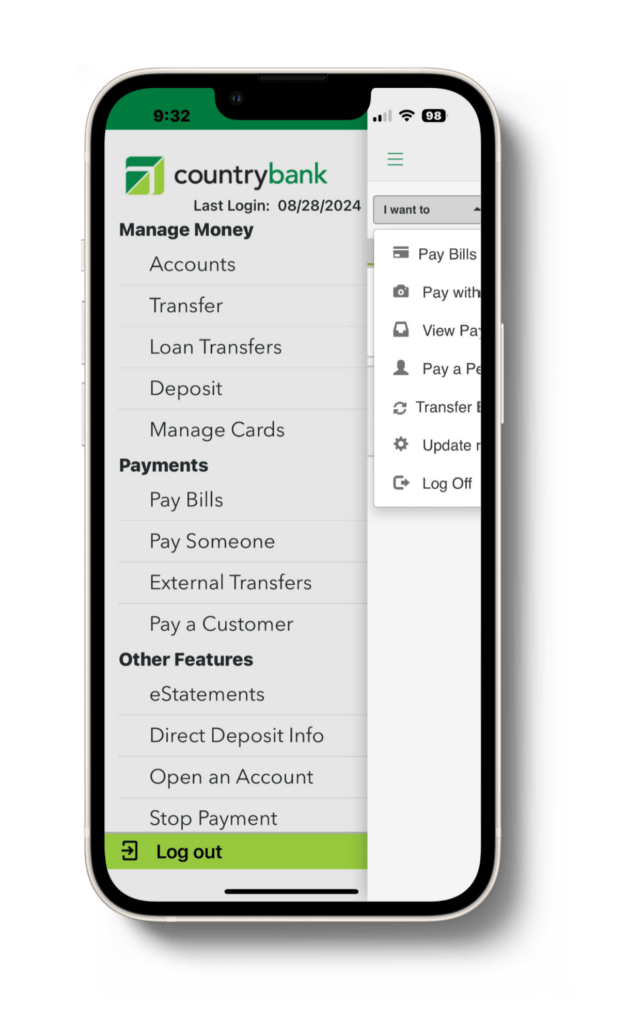

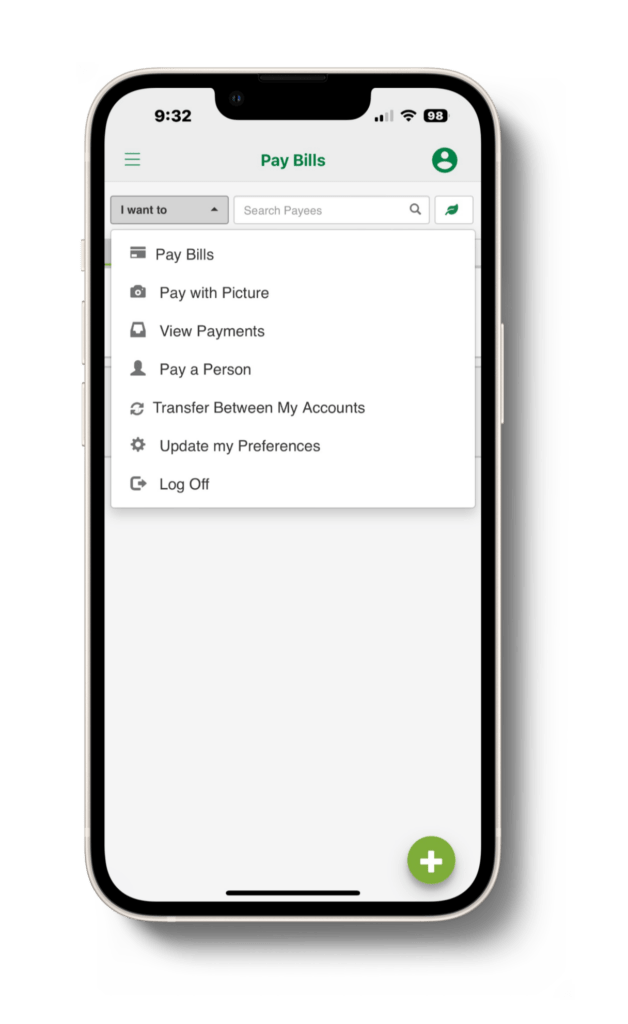

MANAGE YOUR CREDIT BUILDER LOAN WITH MOBILE BANKING

Pay Your Credit Builder Loan

Enjoy the convenience of paying your credit builder loan loan anytime, anywhere.

Monitor Your Account Balances

If you are taking advantage of the rate discount by setting up automatic payments from your Country Bank checking account or savings account, keep an eye on your balances to ensure your loan payment goes through. [LINK ACCOUNTS]

Create Custom Alerts

Set up custom alerts like low balance warnings and security changes so you are always one step ahead of financial mishaps.