COMMERCIAL REAL ESTATE LOAN FEATURES

Competitive Rates

Our commercial mortgage rates can help you finance your business property without breaking the bank. Explore our flexible terms and start planning your next steps with confidence!

Flexible Funds

Invest in your business’s future knowing you have the money to make it happen. Commercial real estate loans can be used to purchase a new property, expand your square footage, or refinance existing business loans.

A Trusted Partner

When you work with our team of experts, you get expertise that can keep up. We are ready to support your growth and bring sophisticated solutions to continue your business success.

COMMERCIAL REAL ESTATE LOANS EMPOWER GROWTH

Elevate Your Business

Commercial real estate loans offer your business a needed source of capital to finance opportunities and investments.

- Invest In Commercial Property:

Buy a commercial property for your business or lease to tenants. - Build Equity:

Transition from renting and become an owner.

HOW TO APPLY FOR COMMERCIAL REAL ESTATE LOANS

Prepare to Save Time

Start early! Preparing your financial documents and understanding your loan options can streamline the process and save you valuable time. Let’s ensure your business is ready to seize the opportunity when the time comes! Get a head start by organizing these documents:

- The legal name of your business

- The business tax ID number

- The business type (LLC/Sole Proprietor/Corporation/etc.)

- Business financial statements and tax returns

- Your personal information and finances

- Property seller’s Schedule E from their tax return or a financial statement, if applicable

- Current listing of each tenant including the lease details and agreement, if applicable

From one local business to another, we take pride in handling the loan processing and underwriting in-house. Have confidence that we will do what it takes to help your business succeed.

THE DIFFERENCE IS IN THE DETAILS

CASH MANAGEMENT SOLUTIONS FOR YOUR BUSINESS

We strive to make life easier for those who put their blood, sweat, and tears into building something that makes our communities better. Explore these cash management options to save you time and simplify your finances.

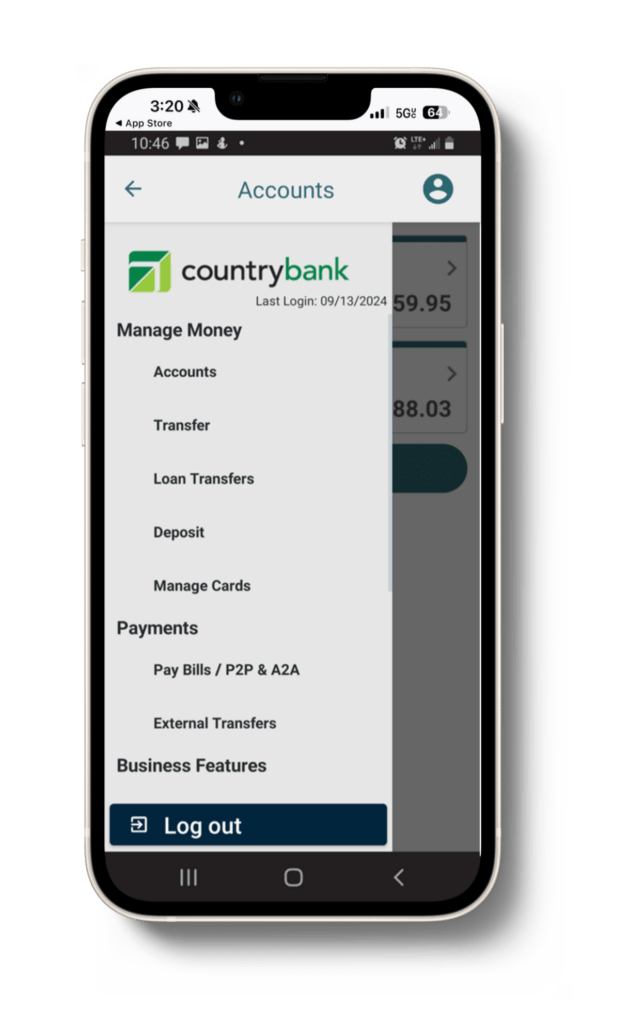

Mobile Banking

Electronic Tax Payments through EFTPS

Remote Deposit Capture

Wire Transfer Services

ACH Services

Check Positive Pay

Line of Credit Sweep

Merchant Services

BUILDING STRONGER COMMUNITIES, ONE LOAN AT A TIME

COMMERCIAL LENDING OFFICERS

When done right, a loan can be the difference-maker in helping your business get ahead. You can count on our lenders to customize a solution that serves the unique needs of your business. A loan that’s flexible, allows for higher lending limits, and delivers on the promises made to you. Trust the relationship. Trust the loan.

Jessica Royce

SENIOR VICE PRESIDENT, COMMERCIAL BANKING TEAM LEAD

jroyce@countrybank.com

Direct Dial: 413-277-2065

Fax: 866-638-8771

Ben Leonard

SENIOR VICE PRESIDENT, COMMERCIAL BANKING TEAM LEAD

bleonard@countrybank.com

Direct Dial: 413-277-2119

Fax: 866-638-8771

Shane Elder

FIRST VICE PRESIDENT, BUSINESS BANKING TEAM LEAD COMMERCIAL LOAN OFFICER

selder@countrybank.com Direct Dial: 413-277-2112 Cell: 508-440-1616

Ryan Nauman

VICE PRESIDENT, COMMERCIAL LENDER

rnauman@countrybank.com

Direct Dial: 413-277-2067

Fax: 866-638-8771

Seth Arvanites

VICE PRESIDENT, COMMERCIAL LENDER

sarvanites@countrybank.com

Direct Dial: 413-277-2106

Fax: 866-638-8771

Michael Demarco

VICE PRESIDENT, COMMERCIAL LENDER

mdemarco@countrybank.com

Direct Dial: 413-277-2073

FAX: 866-638-8771

Patrick O’Hara

VICE PRESIDENT, COMMERCIAL LENDER

pohara@countrybank.com

Direct Dial: 413-277-2111

Fax: 866-638-8771

Jolene Mastalerz

VICE PRESIDENT, PORTFOLIO MANAGER

jmastalerz@countrybank.com

Direct Dial: 413-277-2113

Sarah Yurkunas

COMMERCIAL LOAN RELATIONSHIP OFFICER

syurkunas@countrybank.com

Direct Dial: 413-277-2158

Samuel Pursey

COMMERCIAL LOAN RELATIONSHIP OFFICER

SPursey@countrybank.com

Direct Dial: 413-277-2043

Carla Alves

VICE PRESIDENT, BUSINESS BANKING LOAN OFFICER calves@countrybank.com Direct dial: 413-277-2110 Cell: 413-530-7608

EMPOWER YOUR FUTURE

COMMERCIAL REAL ESTATE LOAN RESOURCES

As a business owner, it’s crucial to manage your finances wisely to ensure growth and stability. From budgeting effectively to investing in the right areas, every decision counts. Take advantage of these tools and tips to secure your business’s future.

Why Small Businesses Should Consider an LLC

Support Small Business Saturday, November 30th: A Celebration of Local Entrepreneurs

Professional Help With Your Business

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

BUSINESS BANKING SIMPLIFIED

MOBILE BANKING

Monitor Your Accounts

Review account balances and transactions for your business checking and business money market accounts.

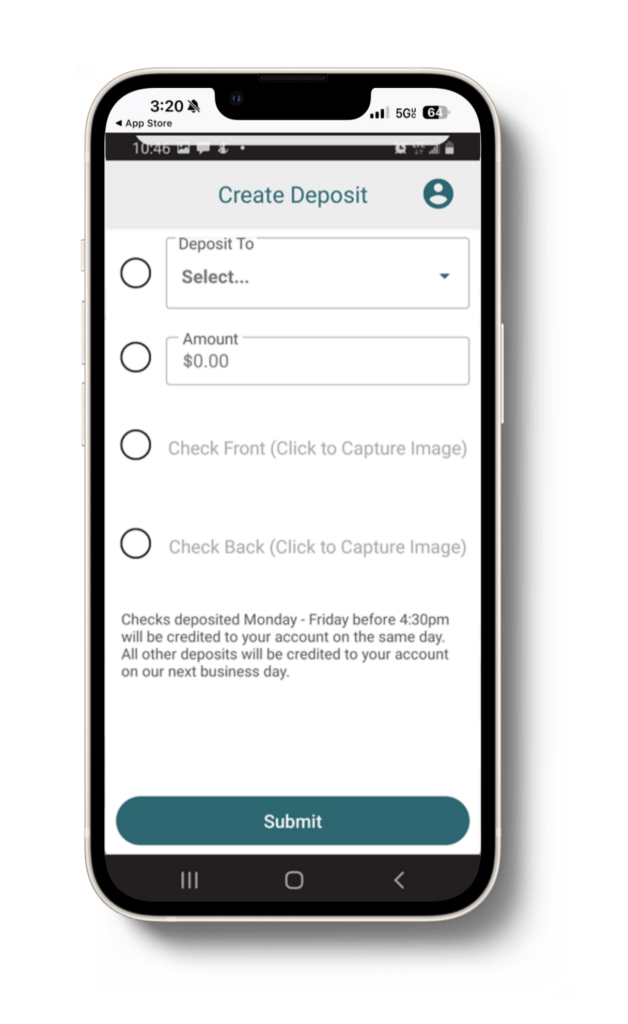

Deposit Checks

Easily deposit your business’s checks from your smartphone 24/7.

Pay Bills

Manage your bills monthly or set recurring payments to stay on top of your business finances.