COMMERCIAL LINE OF CREDIT

COMMERCIAL LINE OF CREDIT FEATURES

We understand the need for your business to have funds accessible to supplement your working capital, to finance inventory, to offset seasonal differences in cash flow or for any other immediate needs that you may have.

WHAT IS A COMMERCIAL LINE OF CREDIT?

A commercial line of credit is a flexible borrowing option for businesses that can be structured in a way that can keep up with the complexities of your business.

GROW YOUR BUSINESS WITH A COMMERCIAL LINE OF CREDIT

Working Capital

Inventory

Seasonal Needs

Equipment Repairs

Expansion

Managing Cash Flow

FINDING YOUR SOLUTION

COMMERCIAL LINE OF CREDIT FAQs

Are my business accounts insured?

- The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

- All deposits above the FDIC limits are insured in full by the DIF

- The combination of FDIC and DIF insurance provides customers of Massachusetts-chartered savings banks with full deposit insurance on all of their deposit accounts

EMPOWER YOUR FUTURE

COMMERCIAL LINE OF CREDIT RESOURCES

As a business owner, it’s crucial to manage your finances wisely to ensure growth and stability. From budgeting effectively to investing in the right areas, every decision counts. Take advantage of these tools and tips to secure your business’s future.

A Guide for Small Business Owners Applying for an SBA Loan

Investing in Impact with Creative Hub

BUILDING STRONGER COMMUNITIES, ONE LOAN AT A TIME

COMMERCIAL LENDING OFFICERS

When done right, a loan can be the difference-maker in helping your business get ahead. You can count on our lenders to customize a solution that serves the unique needs of your business. A loan that’s flexible, allows for higher lending limits, and delivers on the promises made to you. Trust the relationship. Trust the loan.

Jessica Royce

SENIOR VICE PRESIDENT, COMMERCIAL BANKING TEAM LEAD

jroyce@countrybank.com

Direct Dial: 413-277-2065

Fax: 866-638-8771

Ben Leonard

SENIOR VICE PRESIDENT, COMMERCIAL BANKING TEAM LEAD

bleonard@countrybank.com

Direct Dial: 413-277-2119

Fax: 866-638-8771

Shane Elder

FIRST VICE PRESIDENT, BUSINESS BANKING TEAM LEAD COMMERCIAL LOAN OFFICER

selder@countrybank.com Direct Dial: 413-277-2112 Cell: 508-440-1616

Ryan Nauman

VICE PRESIDENT, COMMERCIAL LENDER

rnauman@countrybank.com

Direct Dial: 413-277-2067

Fax: 866-638-8771

Seth Arvanites

VICE PRESIDENT, COMMERCIAL LENDER

sarvanites@countrybank.com

Direct Dial: 413-277-2106

Fax: 866-638-8771

Michael Demarco

VICE PRESIDENT, COMMERCIAL LENDER

mdemarco@countrybank.com

Direct Dial: 413-277-2073

FAX: 866-638-8771

Patrick O’Hara

VICE PRESIDENT, COMMERCIAL LENDER

pohara@countrybank.com

Direct Dial: 413-277-2111

Fax: 866-638-8771

Jolene Mastalerz

VICE PRESIDENT, PORTFOLIO MANAGER

jmastalerz@countrybank.com

Direct Dial: 413-277-2113

Sarah Yurkunas

COMMERCIAL LOAN RELATIONSHIP OFFICER

syurkunas@countrybank.com

Direct Dial: 413-277-2158

Samuel Pursey

COMMERCIAL LOAN RELATIONSHIP OFFICER

SPursey@countrybank.com

Direct Dial: 413-277-2043

Carla Alves

VICE PRESIDENT, BUSINESS BANKING LOAN OFFICER

calves@countrybank.com Direct dial: 413-277-2110 Cell: 413-530-7608

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

BUSINESS BANKING SIMPLIFIED

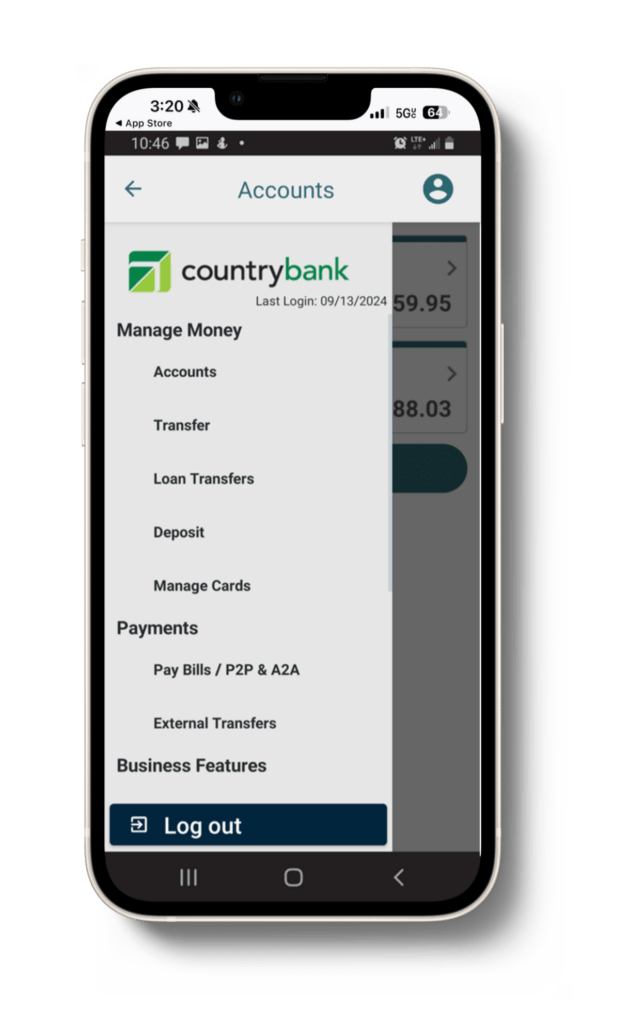

MOBILE BANKING

Monitor Your Accounts

Review account balances and transactions for your business checking and business money market accounts.

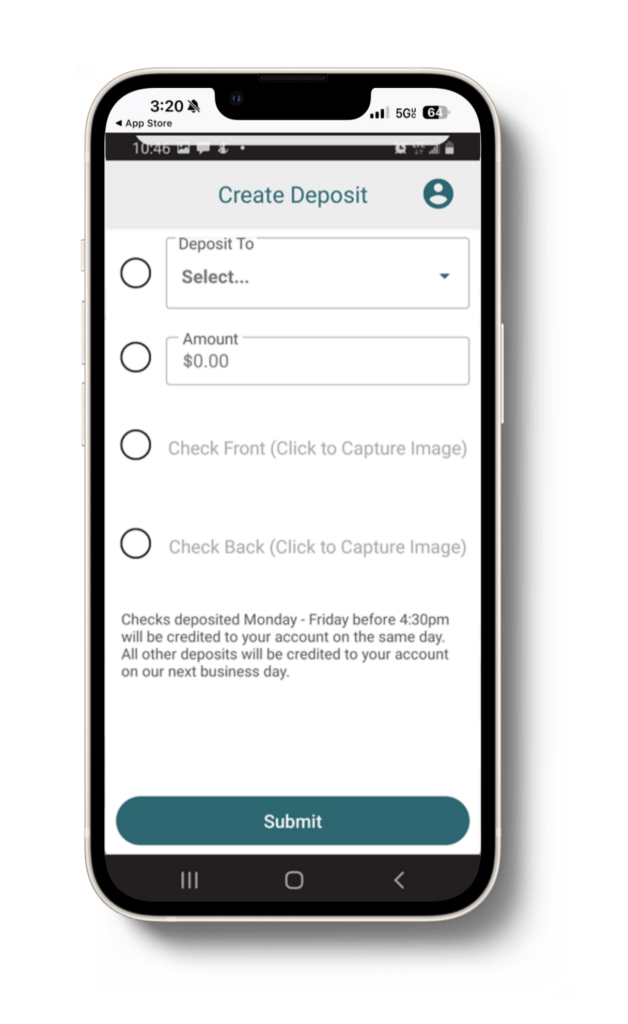

Deposit Checks

Easily deposit your business’s checks from your smartphone 24/7.

Pay Bills

Manage your bills monthly or set recurring payments to stay on top of your business finances.