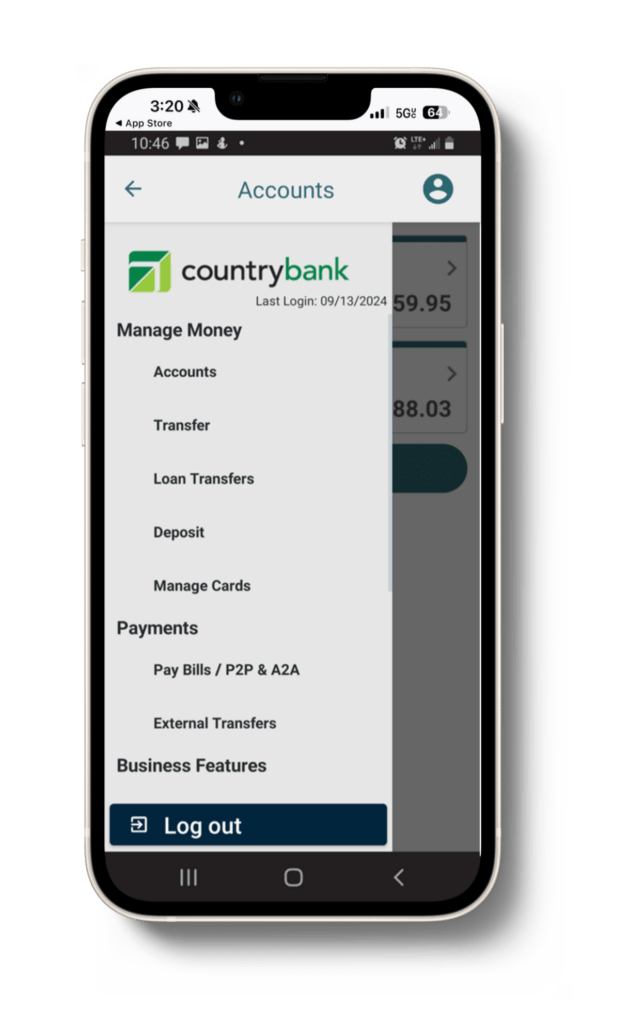

Cannabis Checking Account

No matter how many transactions your business processes or what your daily minimum balance is, Country Bank’s analysis checking account matches your financial situation. Take advantage of earnings credits to offsets fees while maintaining access to treasury services.