BUSINESS MONEY MARKET ACCOUNT FEATURES

Easy Access

Access your funds when you need them with the ability to write checks from your money market account.

Higher Earnings

Don’t settle for less. Grow your business savings with our business money market account!

Low Minimums

Perfect for businesses of all sizes, earn more with a business money market account that can be opened with as little as $500.

BUSINESS MONEY MARKET ACCOUNT FREE UPGRADES:

Mastercard® Debit or ATM Card

Mobile Wallet

Online Banking with Bill Pay

Mobile Banking with Mobile Deposit

Text Banking

eStatements

Telephone Banking

Cash Management Options

WHY A BUSINESS MONEY MARKET ACCOUNT?

Maximize Your Savings

A business money market account is a great business savings account alternative that offers several advantages that make it an attractive option for businesses.

- Liquid Savings: Business money market accounts don’t lock up your savings and offer check-writing capabilities allowing you easy access to your hard-earned money.

- Tiered Interest Rates: Enjoy tiered interest rates, meaning the more you save, the higher the interest rate you can earn on your balance.

- Competitive Earnings: Business money market accounts often offer higher interest rates compared to regular business savings accounts, allowing your funds to grow faster.

BUILDING YOUR BUSINESS

Making Our Communities Stronger, Together.

At Country Bank, we have what it takes to serve businesses of all sizes through our business banking and commercial banking services. Whether a start-up or large commercial enterprise, you’ll find what you need here—from flexibility and customization to an exceptionally high lending limit— because we’re committed to your success. At the end of the day, banking should be about taking care of your business.

SEAMLESS CASH MANAGEMENT SOLUTIONS FOR YOUR BUSINESS:

Automated Clearing House Services (ACH)

Remote Deposit Capture (RDC)

Wire Transfer

Line of Credit Sweep

Check and ACH Positive Pay

Electronic Tax Payments

Merchant Services

Night Depository Services

Business Check Ordering

DRIVE YOUR BUSINESS’S SUCCESS

BUSINESS MONEY MARKET AND SAVINGS RESOURCES

As a business owner, it’s crucial to manage your finances wisely to ensure growth and stability. From budgeting effectively to investing in the right areas, every decision counts. Take advantage of these tools and tips to secure your business’s future.

Giving Tuesday: A Celebration of Local Non-profit Organizations

Why Small Businesses Should Consider an LLC

FINDING YOUR SOLUTION

BUSINESS MONEY MARKET ACCOUNT FAQs

Are my business accounts insured?

Every deposit account at Country Bank is insured in full. In addition to Federal Deposit Insurance Corporation (FDIC) insurance, Country Bank offers Depositors Insurance Fund (DIF) protection.

- The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.

- All deposits above the FDIC limits are insured in full by the DIF

- The combination of FDIC and DIF insurance provides customers of Massachusetts-chartered savings banks with full deposit insurance on all of their deposit accounts

Can I set up electronic tax payments?

Yes, you can pay your taxes through Cash Management or by signing up with EFTPS.

What is remote deposit capture?

Remote deposit capture allows you to scan checks and transmit scanned images to Country Bank for posting and clearing from the comfort of your office. Checks can be scanned to create a digital deposit. This digital deposit is then transmitted over an encrypted internet connection to Country Bank for clearing and posting.

What is check and ACH positive pay?

Check Positive Pay: Welcome to the most powerful tool available to combat check fraud. This service monitors each check presented and matches it to a list of known issued checks. If there is a question or discrepancy, we flag it and let you know.

ACH Positive Pay / Blocks and Filters:

This tool is made to help you fight fraud associated with electronic payments. It gives your business the ability to block all ACH debits and/or credits from posting to your company accounts to prevent ACH fraud—or to control the ACH debits that post to your account.

Contact us if you are interested in adding these services.

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

BUSINESS BANKING SIMPLIFIED

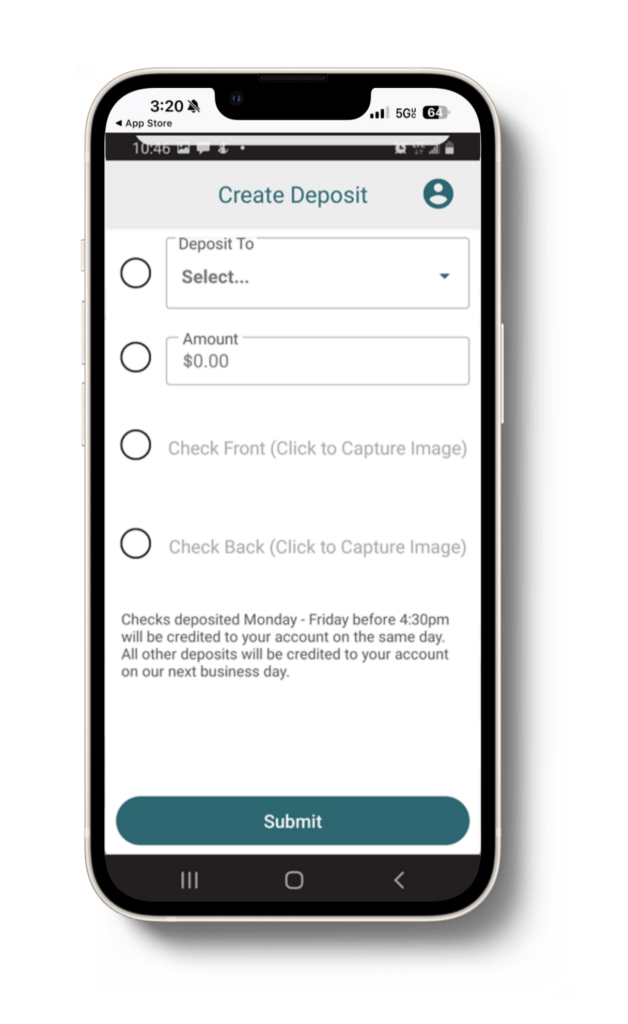

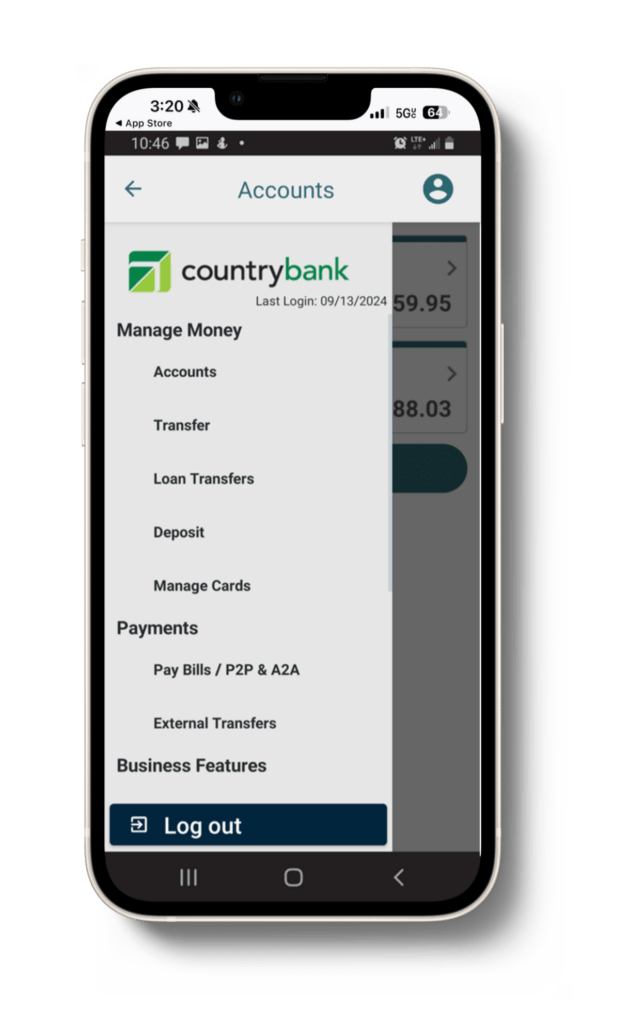

MOBILE BANKING

Monitor Your Accounts

Review account balances and transactions for your business checking and business money market accounts.

Deposit Checks

Easily deposit your business’s checks from your smartphone 24/7.

Pay Bills

Manage your bills monthly or set recurring payments to stay on top of your business finances.