Shane Elder

FIRST VICE PRESIDENT, BUSINESS BANKING TEAM LEAD COMMERCIAL LOAN OFFICER

Direct Dial: 413-277-2112

Cell: 508-440-1616

Partner with a bank who understands and anticipates your needs. We deliver customized problem-solving, industry expertise, and highly responsive service to support your business growth.

Use your funds how your business needs whether it’s upgrading technology and equipment, buying out shareholders, acquiring new companies, or purchasing other long-term assets.

Get the capital you need for your next large business investment or expansion with a partner that can support your growth and help you manage the opportunities ahead.

Smart financing can get you exactly where you need to be—and often even further. Use this loan to finance new or used equipment, update your technology, make leasehold improvements, acquire a company, or buy out shareholders. Our business term loans offer:

Discover a loan that adapts to your vision. Whether you’re expanding, innovating, or investing, Country Bank has business loan solutions tailored to your unique needs.

Focus your funds on driving success with rates designed to take your business further because at Country Bank, it’s not just about banking, we’re here to make a difference for your business.

Fuel your next business venture or expansion with higher lending limits. The right financial partner makes all the difference and Country Bank has the capacity to support your growth.

Take your business to the next level with an express business loan. Whether your business needs updated equipment, leasehold improvements, new technology, or capital for acquisitions, we’re here to help you thrive. Our business express term loans offer:

Funds can be used to expand your business and secure long-term fixed-rate financing to acquire machinery & equipment, vehicles, and other long-term assets.

With our easy application process and rapid decisioning, you’ll be back to growing your business in no time.

Fund up to $50,000 with a maximum loan to value of 80% and enjoy no early termination fees.

When done right, a loan can be the difference-maker in helping your business get ahead. You can count on our lenders to customize a solution that serves the unique needs of your business. A loan that’s flexible, allows for higher lending limits, and delivers on the promises made to you. Trust the relationship. Trust the loan.

FIRST VICE PRESIDENT, BUSINESS BANKING TEAM LEAD COMMERCIAL LOAN OFFICER

Direct Dial: 413-277-2112

Cell: 508-440-1616

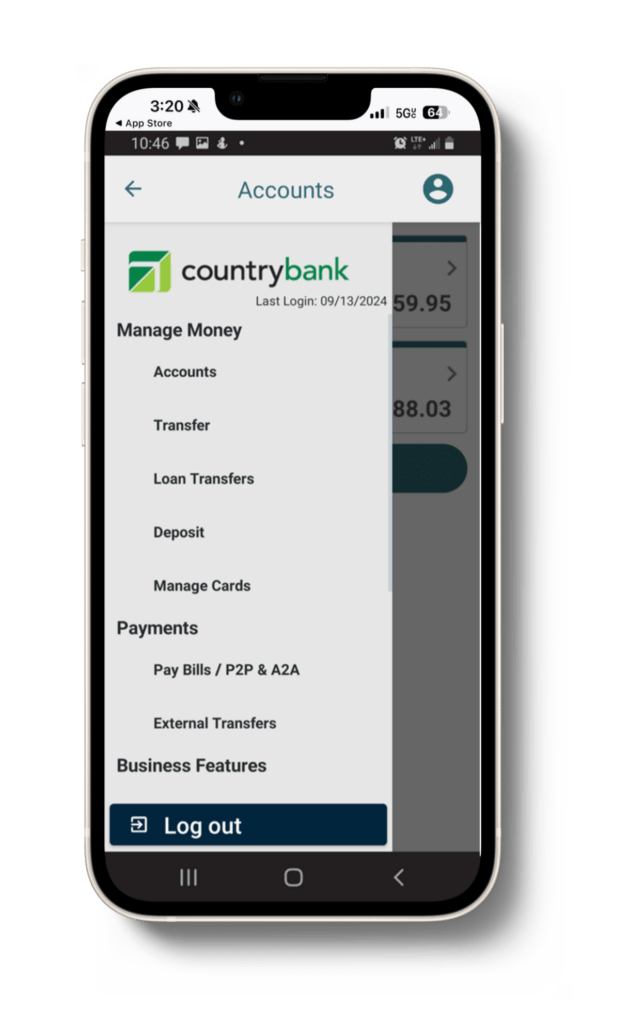

Experience the difference of exceptional service when you stop by a local banking center.

Review account balances and transactions for your business checking and business money market accounts.

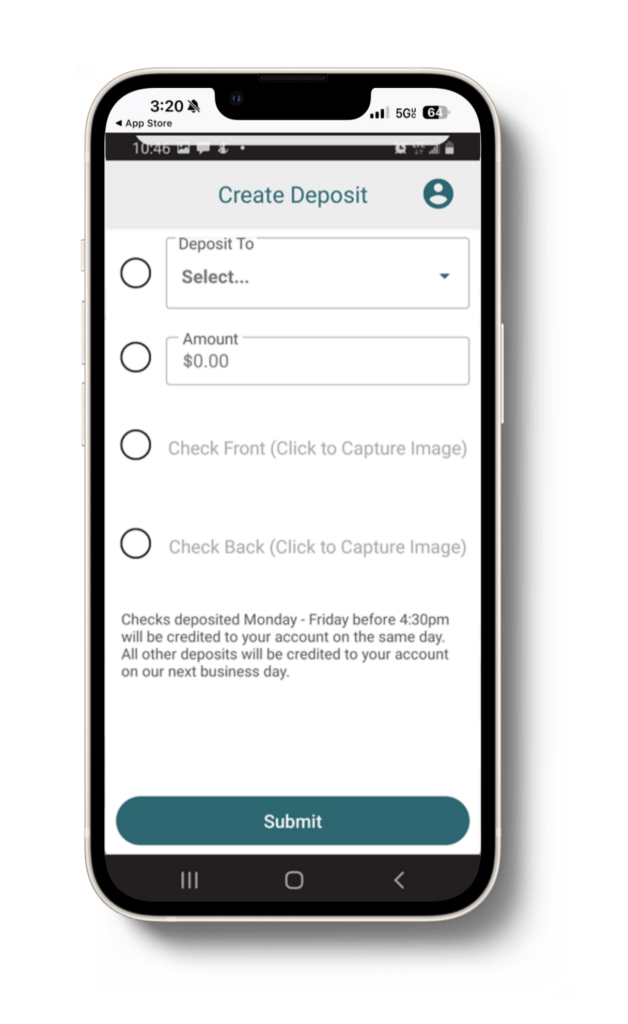

Easily deposit your business’s checks from your smartphone 24/7.

Manage your bills monthly or set recurring payments to stay on top of your business finances.