Mobile Banking

Skip the trip and take control of your finances with our secure mobile banking app.

Swipe, Tap, Bank

MOBILE BANKING FEATURES

BUSINESS BANKING SIMPLIFIED

MOBILE BANKING

Monitor Your Accounts

Review account balances and transactions for your business checking and business money market accounts.

Deposit Checks

Easily deposit your business’s checks from your smartphone 24/7.

Pay Bills

Manage your bills monthly or set recurring payments to stay on top of your business finances.

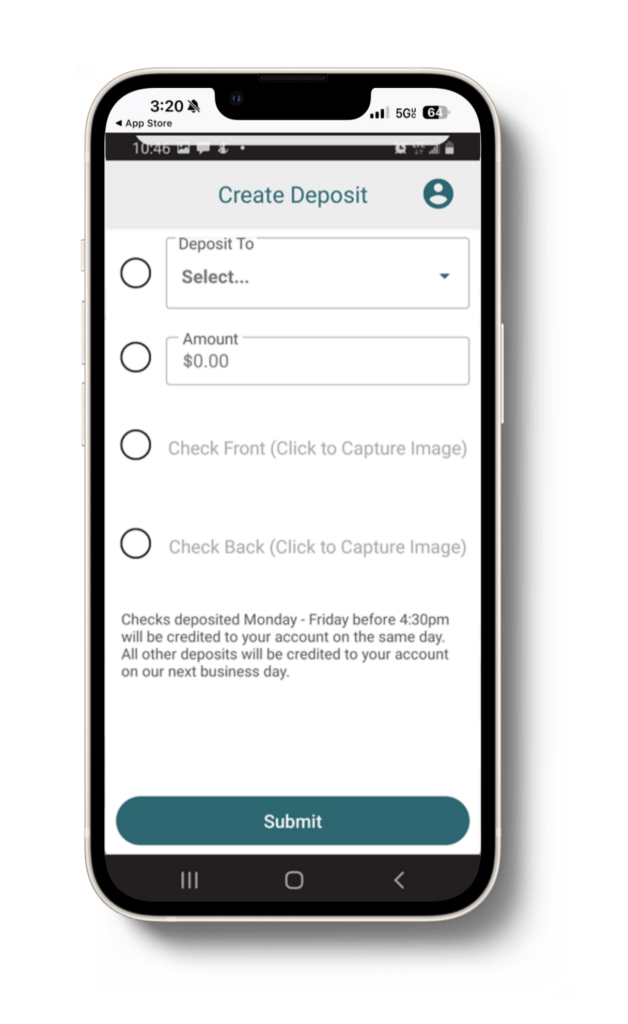

MOBILE CHECK DEPOSIT: BANK WITHOUT BOUNDARIES

Open the Mobile Banking App

Log into the app and select “Deposit” from the menu.

Endorse Your Check

Endorse your check and be sure to write “For mobile deposit only at Country Bank” below your signature.

Follow the Prompts

Follow the simple steps to take photos of your check and complete your transaction.

Mobile check deposits are subject to verification and may not be available for immediate withdrawal.

DIGITAL WALLET: CARRY LESS, DO MORE

We support digital wallet payments with Apple Pay®, Samsung Pay® and Google Pay®. Simply use your phone to make payments anywhere mobile purchasing services are accepted.

HOW IT WORKS:

- Open your digital wallet on your iPhone (for Apple Pay) or download the Samsung Pay app or Google Pay app on your phone, and then add your Country Bank Mastercard® debit card information. Once your card is added, please contact us to activate this service.

- At checkout, hold up your device to the scanner to make a purchase. Since your card is digitally encrypted, there’s an extra layer of security every time you choose to pay with digital wallet.

SIMPLIFY YOUR FINANCIAL LIFE WITH OUR MOBILE BANKING APP

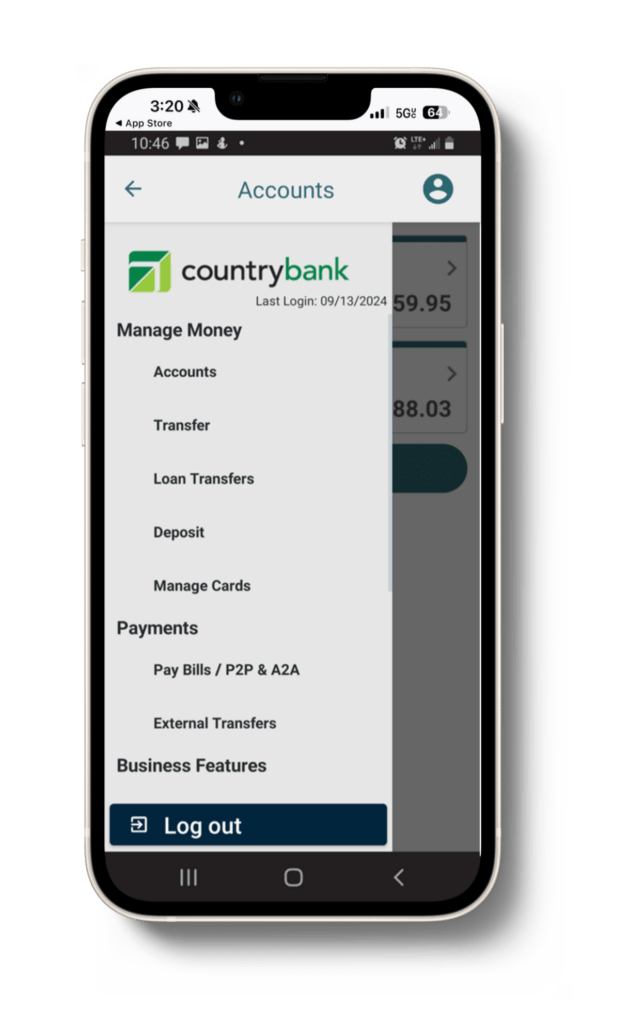

Discover the freedom and flexibility of managing your finances on the go. Once you’re enrolled in online banking, all you need to get started is to download our app onto your smartphone or tablet. Manage your money from the palm of your hand with these great tools:

- Check your account balances

- Transfer money between your accounts

- View your direct deposit info

- Sign up for eStatements

- Save a receipt or keep warranty info by attaching a photo to a transaction

- Make a payment on your Country Bank loans

- Transfer money to friends or family

- Contact us through secure in-app messaging

- Find a convenient location near you

- Manage Cards

- Mobile Deposit

- Bill Payments

- Open an Account

MOBILE BANKING SECURITY MAKES A DIFFERENCE

Protecting your financial information is our priority. We use 128-layer bit encryption, username and password requirements, multifactor authentication (MFA), timed user sessions, and automated logout when the device is locked, plus there’s a lot we do behind the scenes that we can’t tell you about!

Take your security to the next level with these additional features:

- Deactivate your cards if they are lost or stolen

- Set spending limits to restrict transaction amounts

- Restrict specific merchants or transaction types

- Set up custom alerts like low balance warnings and security changes

FINDING YOUR SOLUTION

MOBILE BANKING FAQs

How do I enroll for mobile banking?

- Last 4 digits of your Social Security Number

- Your Zip Code

- A valid phone number or email on file to receive a one-time authentication code (also known as MFA or Multi Factor Authentication)

How do I enroll in eStatements?

Enroll for eStatements in online banking or mobile banking by clicking “Other Features” in the menu bar, select eStatements, and then click “Delivery Preferences” to complete setup. If you open new accounts after you are enrolled, you will need to enroll your new account(s) in eStatements by following the same process.

Can I deactivate my card in online banking or the mobile app if it’s lost or stolen?

You can temporarily shut off your debit card by selecting “Manage Cards” from the Mobile Banking menu. When you temporarily shut your card off, it blocks transactions from posting to your account. If you find your card, you can turn it back on instantly. If you find that you really did lose your card, call us at 800-322-8233 to report it lost during normal business hours or call 833-933-1681 after normal business hours.

What payment types are available in Bill Pay and Picture Pay through the app?

Electronic or check payments can be made in both Bill Pay and Picture Pay. Both Bill Pay and Picture Pay requires a full account number for a payment to get sent electronic/ACH. If your bill does not have a full account number, you can still snap a photo, and edit the payee afterwards to enter the full account number.

HOW CAN WE HELP YOU

CUSTOMER SERVICE

Locations

Experience the difference of exceptional service when you stop by a local banking center.

FIND LOCATIONS