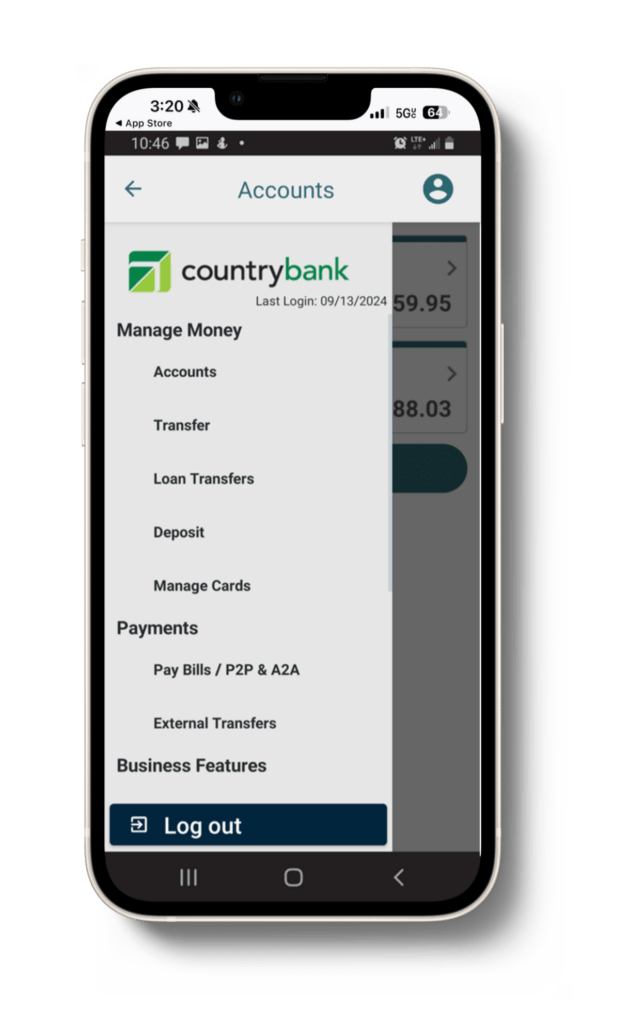

Manage Accounts 24/7

View your account balances, transfer money, manage your cards, and more!

View your account balances, transfer money, manage your cards, and more!

Pay loan balances, people, and external accounts anytime day or night.

Take your banking to the next level with our online services. Efficiently manage your finances anytime, anywhere!

Manage your payments on your schedule with bill pay.

Bill pay’s eBill function lets you pay bills immediately and set recurring payments in the future so you never forget a payment!

Review graphs to help you visualize how your money is spent with bill pay’s reporting tool.

Download your online banking transactions and manage your finances easily with bill pay.

You must use the current year version or a version from the previous two years for Quicken and QuickBooks to be compatible.

Receive an email alert verifying that any new account added to your bill pay is an authorized funding option.

Not only are eStatements secure through online banking, they also reduce the risk of sensitive information being lost or stolen in the mail.

Access your statements and check images through online and mobile banking anytime, anywhere!

Get added security and convenience at no extra charge with eStatements!

By going paperless, you’re making a difference by reducing paper waste and helping the environment.

Protecting your financial information is our priority. We use 128-layer bit encryption, username and password requirements, multifactor authentication (MFA), timed user sessions, and automated logout when the device is locked, plus there’s a lot we do behind the scenes that we can’t tell you about!

Take your security to the next level with these additional features:

Direct deposit, electronic check, point of sale and ATM/debit transactions are shown as external transactions. The detail of where the transaction took place is listed below the entry.

Each screen has a green printer icon next to the “logout” button. By clicking on it, you will get a clean version of your history.

Click on ‘Forgot Username or Password’ and follow the prompts. If you’re still having issues, please contact our Customer Care Center at 800-322-8233. After business hours, feel free to send a secure email to let us know you need assistance logging in and one of our Customer Care Center team members will contact you as soon as possible on the next business day.

Currently, the system will allow you to retrieve the prior eighteen months of account statements. If you need information prior to that, please contact us at 800-322-8233 and our Customer Care Center would be delighted to assist you.

Due to legal requirements, we limit the ability to make certain types of payments. Payments outside the United States are prohibited and may not be issued under any circumstances. The following payments may be scheduled at your own risk: federal, state and local government tax payments or municipalities. We also cannot allow payments for anything court-directed. These entities will not work with a third party to settle your bill if the payment becomes lost in the mail or credited improperly.

You can change your checking account once you click on Pay to schedule a payment.

Click on the “Add Payee” option within bill pay and enter the payee name indicated on your most recent billing statement. A list of similar payee names will appear in a drop-down, choose the appropriate one or type your own. Every new payee is reviewed in an attempt to make them an electronic payee. So, even if a match is not immediately found, the payee may be converted at a later time, following the review period. Continue with the prompts to accurately list all information found on your billing statement to insure your payments are received timely and posted accurately.

You may schedule a payment years into the future, however, we recommend not scheduling too far into the future as you may forget about them or the due date or dollar amounts may change. You can choose the payment date to be indefinite when setting up a recurring payment.

Bill payment history can be retrieved for the previous 12 month period.

If you are not able to delete the payment it may have already been processed. If the payment was sent by check, contact us right away at 800-322-8233 or send a secure email after business hours and one of our Customer Care Center team members will contact you as soon as possible on the next business day.

If your payment was sent electronically, you should contact the payee to determine what they can do to assist you. Since we cannot electronically retrieve your money, it is up to the payee to decide if and how they will reimburse you.

Transactions are limited to $10,000 each. Total number of payments cannot exceed $30,000 per day; $10,000 in check payment(s), and a combined total $20,000 in electronic payments.

Click Edit Payee and edit the nickname, account number, payee email, memo, and/or address. If the Name of the company changed, you will need to create a new payee and delete/deactivate the old payee to avoid payment issues.

Not right away. When you delete a payee, you also delete the payment history. For this reason, we suggest you either print your payment history or deactivate the payee from inside bill payment. This will allow you to obtain your payment history at any time but remove them from your “Make Payments Screen” so errors do not occur.

If you receive an error message while making a payment, click on the “View Reports” link and verify that the payment was scheduled. If it appears in the list with a confirmation number, your payment is scheduled to be made. If you do not see it, the command never reached the server and you should make the payment again. If you are in doubt, call our Customer Call Center at 800-322-8233 and we can verify the scheduled payments using our administration site.

If the payee is being paid with an electronic payment, the amount of the payment will be deducted from your account within 2 business days of the payment processing date.

If the payee is being paid with a check, the amount of the payment will not be deducted from your account until the check is presented for payment.

Experience the difference of exceptional service when you stop by a local banking center.

Review account balances and transactions for your business checking and business money market accounts.

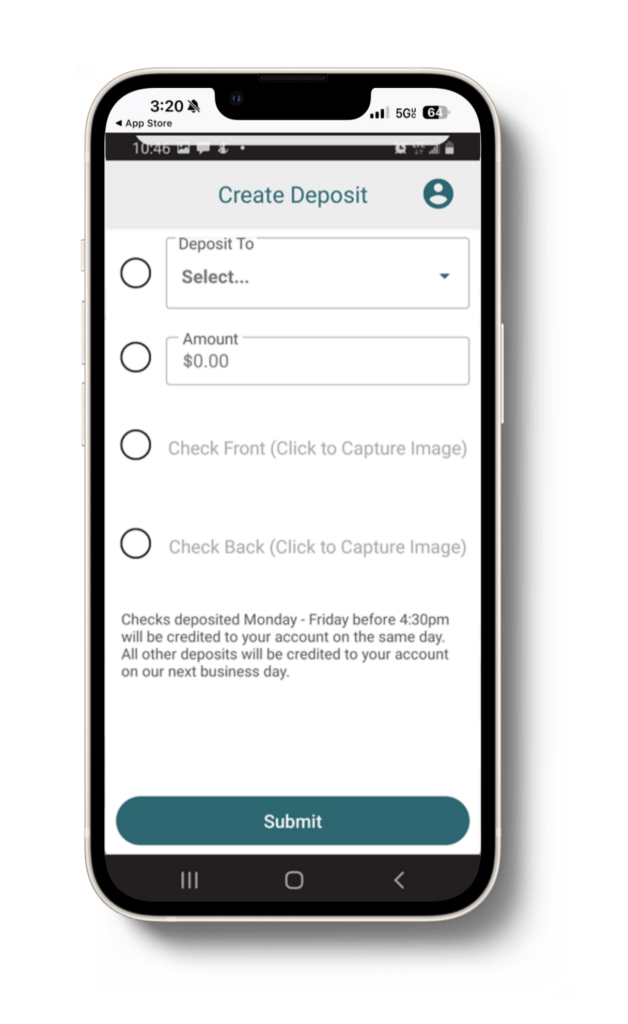

Easily deposit your business’s checks from your smartphone 24/7.

Manage your bills monthly or set recurring payments to stay on top of your business finances.