Debit Cards

Not all card swipes are created equal. A debit card may look like a credit card, but instead of borrowing […]

Read More

Make every mile count with attractive auto loan rates and auto refinance rates that complement your budget.

| Year of Vehicle | Max Term | Interest Rate | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|

| 2023-2025 | 60 Months | 6.250% | 6.250% | $19.45 |

| 2023-2025 | 72 Months | 6.500% | 6.500% | $16.81 |

| 2020-2022 | 60 Months | 6.750% | 6.750% | $19.68 |

| 2019 & older | 36 Months | 6.500% | 6.500% | $30.65 |

Maximum Loan to Value – 95%

Insurance Binders will be required at the time of closing

Minimum loan: $800

Minimum term: 12 months

If payment is automatically deducted from a new or existing Country Bank checking or savings account, the rate will be reduced by 0.250 percentage points. New accounts must be opened prior to closing.

All loan applications are subject to credit approval.

Whether you’re looking for a new or used vehicle, start your journey with budget-friendly auto loan rates.

Reduce your auto loan interest rate by 0.250 percent when you set up automatic deduction from your new or existing Country Bank checking or savings account. New accounts must be opened prior to closing.

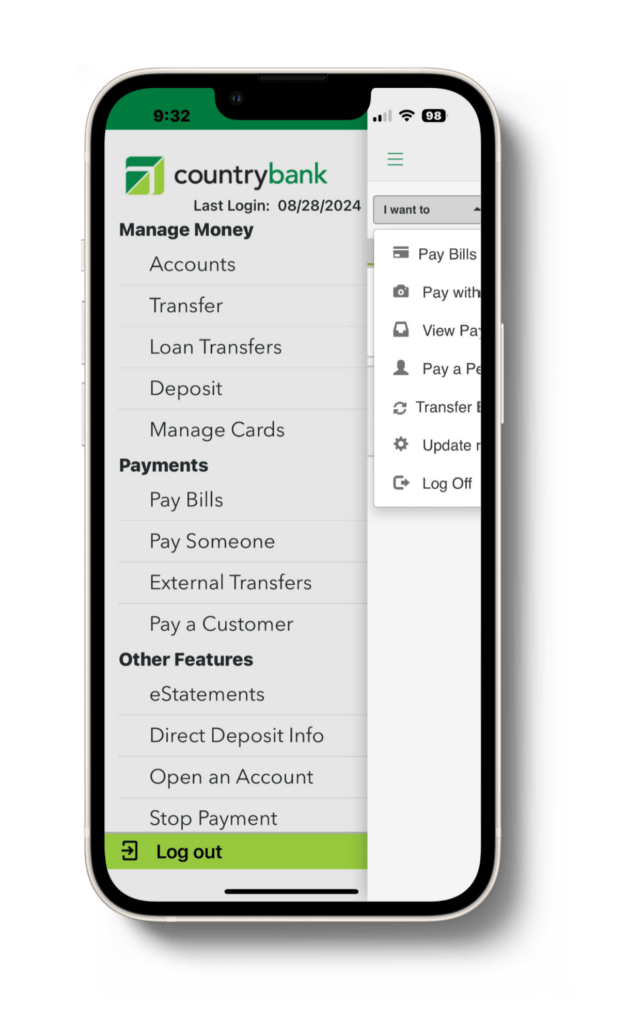

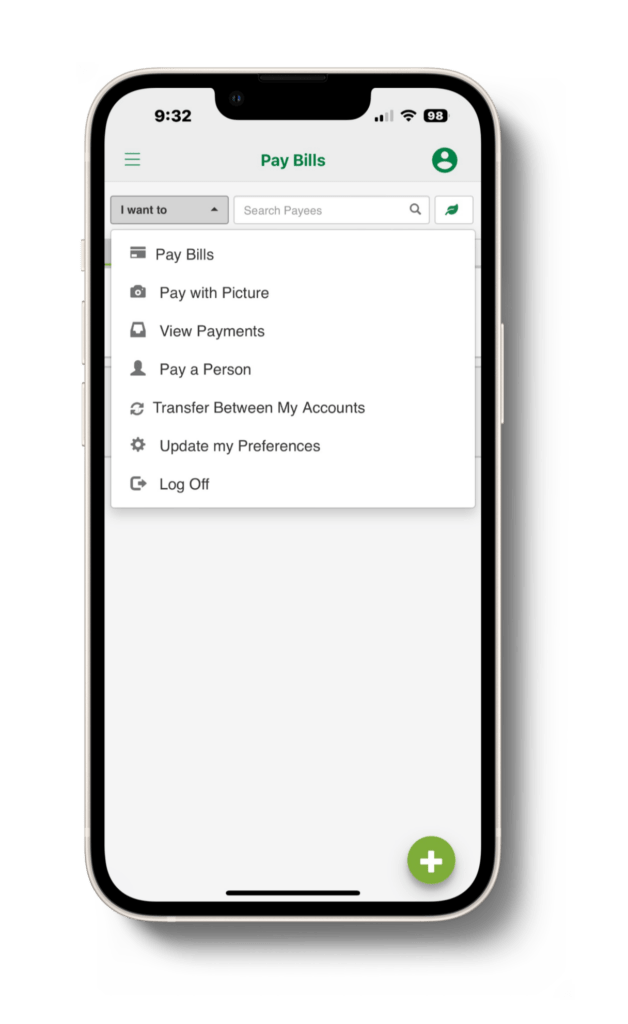

Mobile App

Any Banking Center

This calculator is for informational purposes only and its use does not guarantee an extension of credit. Your actual term and payment will be provided upon acceptance of a Country Bank Loan.

Making smart choices with money can make a major difference in your life. Take advantage of these tools and tips to stay one step ahead and secure your financial future.

Not all card swipes are created equal. A debit card may look like a credit card, but instead of borrowing […]

Read More

Borrowing money makes it possible to afford things that you couldn’t otherwise, but make sure you understand what you’re signing […]

Read More

Making payments on a loan with suboptimal terms can make you feel trapped. Luckily, refinancing can help you find more […]

Read MoreFinancing options are available for up to 95% of the value of the vehicle.

Apply today, and we may be able to help you adjust your loan term for a more affordable monthly payment

Experience the difference of exceptional service when you stop by a local banking center.

FIND LOCATIONS

Enjoy the convenience of paying your auto loan anytime, anywhere.

Take charge of your finances with easy access to your outstanding auto loan balance.

Save money when you make an extra payment toward the principal of your auto loan.