Justin Calheno

VICE PRESIDENT, RETAIL LENDING BUSINESS DEVELOPMENT OFFICER NMLS #5549 jcalheno@countrybank.com Direct Dial: 413-277-2370 Cell: 413-626-0395 Fax: 413-234-3243

APPLY NOW

Save $1,500 on your mortgage closing costs with our first-time homebuyer program if you open or have an existing Country Bank checking account plus 4 additional qualifying services.

Affordable mortgage rates make all the difference when it comes to turning your dreams of homeownership into an exciting reality.

| Product | Interest Rate | Points | CAPS | Annual Percentage Rate | Monthly Payment per $1,000 |

|---|---|---|---|---|---|

| 10/1 ARM First Time Home Buyer (30 Year) | 6.250% | 0 | 1% / 4% | 7.181% | $6.16 first ten years (120 payments), $6.22 after initial adjustment (240 payments) |

| 30 Year Fixed First Time Home Buyer | 6.500% | 0 | N/A | 7.404% | $6.32 |

| No Down Payment First Time Homebuyer 10/1 ARM (30 Year)** | 6.000% | 0 | 1% / 4% | 7.002% | $6.00 first ten years (120 payments), $6.17 after initial adjustment (240 payments) |

| 30 Year Fixed No Down Payment First Time Homebuyer** | 6.250% | 0 | N/A | 7.140% | $6.16 |

Disclosure:

All Annual Percentage Rates (APR) listed below assume a $165,000 mortgage and a 20% down payment unless otherwise stated. Private Mortgage Insurance (PMI) required if the down payment is less than 20%.

**Lender-paid Private Mortgage Insurance (PMI); Income and Property Location Restrictions Apply.

Rates shown are for owner-occupied properties.

Rates, APR (Annual Percentage Rate) and margin are subject to change based on factors such as points, loan amount, loan-to-value, borrowers credit, property type and occupancy.

Payments do not include amounts for taxes and insurance premiums, if applicable; the actual payment obligation will be greater.

All loan applications are subject to credit approval.

Country Bank offers 60 day rate locks. You have the ability to lock in your interest rate for 60 days at any time during the loan process (up until 10 days before the closing) For all Adjustable Rate Mortgages (ARM), the Rates May Increase After Consummation. Mortgage payments per $1,000 based on 30-year amortization. The margin on all Adjustable Rate First Time Home Buyer mortgages (ARM) is 2.250%, unless otherwise noted.”

Take the extra cash to the bank! Receive a discount on your first time home buyer loan closing costs when you meet applicable requirements.

Bring on the extra savings. Skip the cost of private mortgage insurance (PMI) and put that money to good use elsewhere!

Disclaimer: This calculator is for informational purposes only and its use does not guarantee an extension of credit. Your actual term and payment will be provided upon acceptance of a Country Bank Loan.

Dreaming of owning your first home? Discover if you are eligible for our No Down Payment First Time Home Buyer loan program. Here’s what you’ll need to qualify:

Contact one of our Mortgage experts to see if you qualify.

First time home buyers and buyers with low or moderate incomes have choices when it comes to buying a home. Massachusetts residents can unlock the possibilities with the Freddie Mac’s Home Possible program.

When you’re applying for a mortgage, it’s important to have someone you trust at your side. We’re experts at walking you through the entire process, answering your questions, and cheering you on to success. It’s what we’re made to do.

VICE PRESIDENT, RETAIL LENDING BUSINESS DEVELOPMENT OFFICER NMLS #5549 jcalheno@countrybank.com Direct Dial: 413-277-2370 Cell: 413-626-0395 Fax: 413-234-3243

APPLY NOW

RETAIL LOAN OFFICER NMLS #432695 jsoucia@countrybank.com Direct Dial: 413-277-2348 Cell: 413-262-2141 Fax: 866-757-5784

APPLY NOW

RETAIL LOAN OFFICER NMLS #618959 jvelez@countrybank.com Direct Dial: 413-277-2318 Cell: 413-636-2925 Fax: 866-506-7515

APPLY NOW

RETAIL LOAN OFFICER NMLS #432698 kkemp@countrybank.com Direct Dial: 413-277-2383 Cell: 774-200-5017 Fax: 866-726-4071

APPLY NOW

RETAIL LOAN OFFICER

NMLS #689658

lsanchez@countrybank.com

Direct Dial: 413-277-2041

Cell: 413-209-4823

Bilingual – English & Spanish

Servicio en Español

Take control of your future finances and set yourself up for success by making informed mortgage choices today.

Borrowing money makes it possible to afford things that you couldn’t otherwise, but make sure you understand what you’re signing […]

Read More

Making payments on a loan with suboptimal terms can make you feel trapped. Luckily, refinancing can help you find more […]

Read More

If you’ve ever financed a car or taken out a mortgage, you’ve likely heard the word “amortization” tossed around. It’s […]

Read MoreWe have you covered! Here is the information you’ll need when you are ready to apply for a mortgage.

STEP 1: GET PRE-QUALIFIED TO MAKE YOUR PURCHASE

Fill out a mortgage application for a prequalification. As part of this process we will obtain your credit report and request income documentation. We will then determine the amount you would be approved for and issue a prequalification letter. This letter can be used to put in an offer on a home.

STEP 2: APPLYING FOR YOUR MORTGAGE LOAN

If you are purchasing a property, you will want to contact your loan officer to get your mortgage application started and submitted once an offer is accepted. If you already own the property than simply reach out to a loan officer to get the mortgage application started and submitted.

STEP 3: REVIEW LOAN ESTIMATE

Once we have received and processed your submitted mortgage application, you will receive your initial loan disclosure paperwork which includes your loan estimate (a breakdown of potential closing costs associated with your transaction).

STEP 4: PROPERTY APPRAISAL

Once you have reviewed your initial disclosure package and signed your intent to proceed. The appraisal fee will be collected and your appraisal will be ordered. The property will be appraised to establish its current market value.

STEP 5: UNDERWRITING PROCESS

The Loan Processor will submit your paperwork to a Residential Mortgage Underwriter who will underwrite this file to secondary market guidelines.

STEP 6: LOAN APPROVAL PACKAGE

After underwriting has approved your mortgage, the loan approval package will be sent out to you. Typically, this package will contain any outstanding loan conditions that are needed before the closing can be scheduled with the attorney. Once underwriting has received and reviewed the outstanding conditions, the loan will be cleared to close. At that point you will begin to work on scheduling the closing with your attorney. At least three days before your closing, you will receive your initial closing disclosure. This is a very important document as it breaks down the amount needed to bring to the closing.

STEP 7: CLOSING

The “closing” is the last step in buying and financing a home. This is when you and all the other parties in a mortgage loan transaction sign the necessary documents. Before you sign, make sure you carefully read and understand all the loan documents.

Closing costs are the fees you pay to complete your loan; they include but are not limited to origination fee, title insurance, prepaid escrows, and more. Closing costs will vary depending on many different factors including the loan program applied for, down payment, etc. Your loan officer will provide you with a loan estimate that will break down expected closing costs.

Disclosures

*Maximum financing is based on sales price or appraised value, whichever is less. Additional Disclosures: Homebuyer counseling required prior to closing. For 2 family properties, Landlord counseling is also required prior to closing. First Time Homebuyer is classified as not having owned a home within the last 3 years. Property being purchased must be located in Country Bank’s Assessment Area. $1,500 closing cost credit is only valid on First Time Homebuyer Program applications received, approved and closed with Country Bank. First Time Homebuyer program restrictions apply. All loan applications subject to credit underwriting and property approval (subject to change at any time). The incentive will be applied as a Lender Credit on the Closing Disclosure at time of closing if you open or have an existing Country Bank checking account, along with a minimum of four (4) of the following services: Internet Banking with e-Statements, Mobile Banking, Statement Savings Account/Money Market Account, Debit Card or ATM Card, Direct Deposit into your Country Bank checking account or Automatic payment of your mortgage from your Country Bank checking account. Other fees may apply. All accounts and services must be established within twenty (20) days from the date of application or the incentive to receive the credit is null and void. All accounts and services are subject to individual approval. Cannot be combined with any other offer. Only one (1) coupon per mortgage application allowed. This offer can be withdrawn at any time.

Experience the difference of exceptional service when you stop by a local banking center.

FIND LOCATIONS

Knowing where your current mortgage stands can help you manage refinancing possibilities in the future.

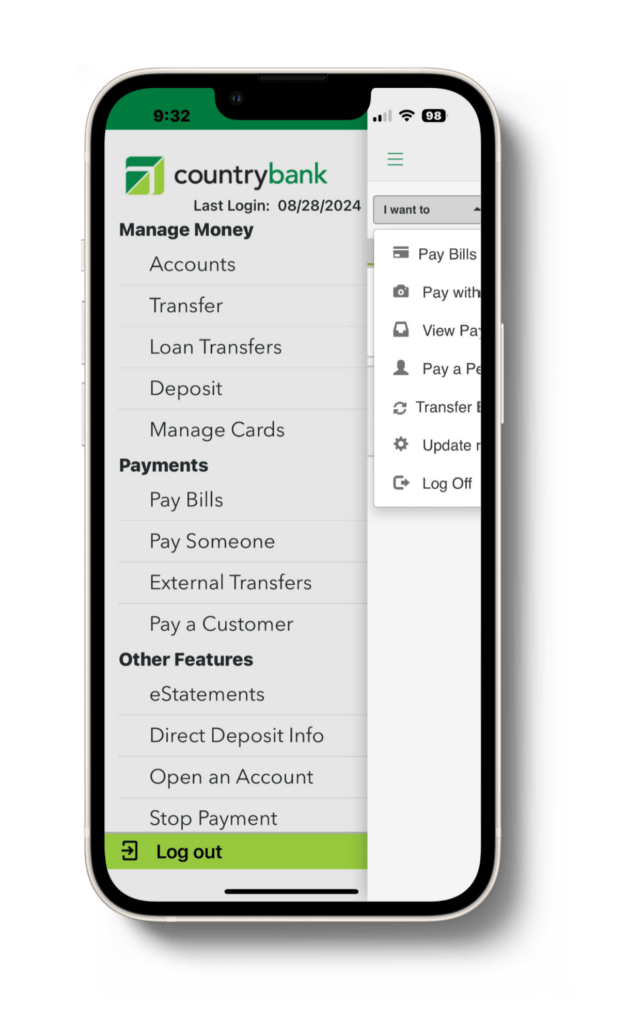

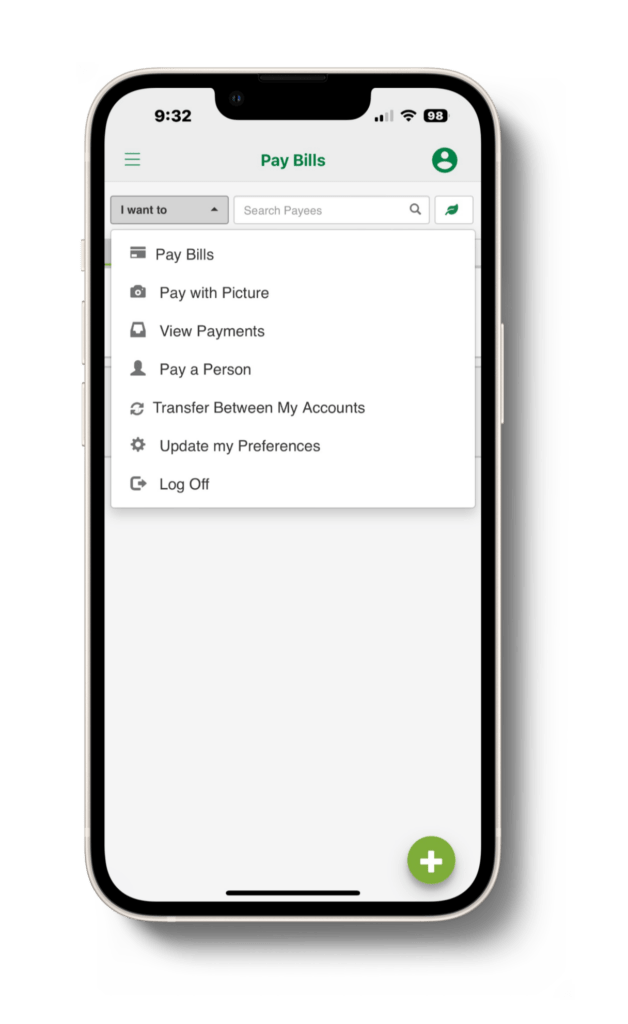

In just a few taps, you can pay your mortgage or even set up a recurring payment so you can focus on what matters most.

Make an extra principal-only payment on your mortgage so you can pay your loan off faster.